Overview

Profitable top-line growth comes from identifying and seizing opportunities within the market. HSG works with health systems to comprehensively identify and implement strategies at the market and service line level to achieve success.

How We Prioritize Opportunities

- Expansion of Geographic Footprint

- Provider Recruitment and Placement

- Specialty Service Line Growth

- Patient Origination and Retention

- Utilization of Existing Provider Capacity

- Alignment Opportunity with Independent Providers

- Partnership Opportunity with Other Health Systems

How We Leverage and Evaluate Data

- Market Data Review

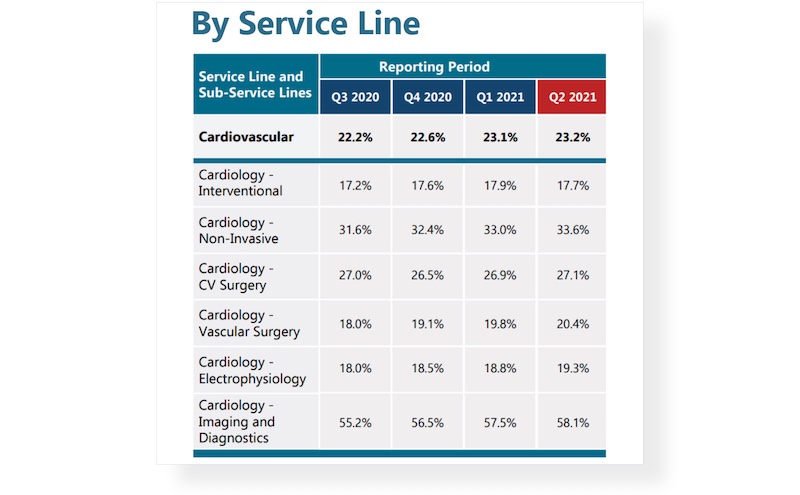

- HSG Inpatient Market Share

- HSG Outpatient Market Share™

- HSG Patient Flow™

- HSG Provider Dashboard

- HSG Inpatient Market Projections

- HSG Outpatient Market Projections

- HSG Market Demographics

- HSG Provider Supply and Demand

- Employed Provider Network Review

- Provider Productivity

- Provider Compensation

- Provider Access

- APP Utilization

Additional HSG Dashboard Workbooks

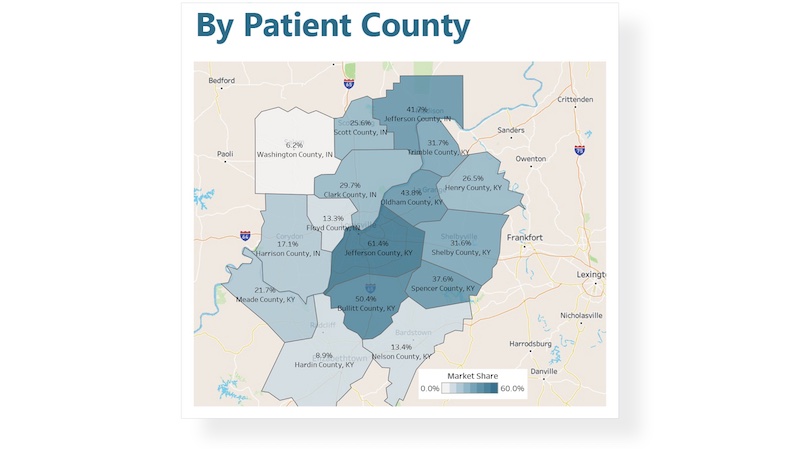

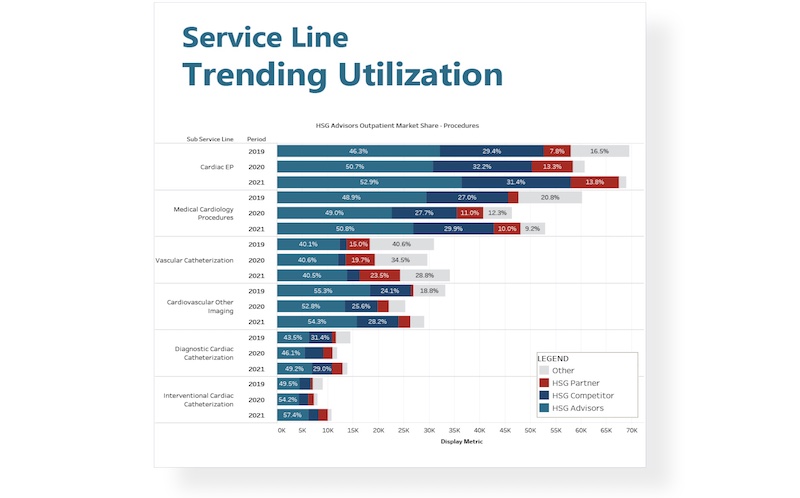

HSG Outpatient and Ambulatory Market Share

Evaluate health system overall market share, service line and subservice line market share, and geographic market share for professional and technical components of all relevant service lines across the Outpatient, Ambulatory and Physician Office environments.

HSG State-Level Market Share

Better understand Inpatient Utilization trends at the market, service line, and subservice line levels and visualize these data sets consistently with HSG Outpatient Market Share.

HSG Patient Flow™

Track patient utilization of the care continuum after an interaction with a potential referring provider, allowing health systems to determine network leakage and prioritize opportunities to addressing leakage.

HSG Patient Share of Care

Track overall patient utilization of the care continuum within a given market, focused on determining the total share of patient healthcare spend that a health system is capturing within a discrete patient population.

HSG Provider Dashboard

Track delivery of patient care by individual providers, practices and physician groups by specialty, allowing health systems to have insight into how individual groups and providers (employed, aligned, competitive) are performing in the Outpatient and Ambulatory market.

Related Resources

-

Strategic Implications of the Pandemic

As the nation begins to emerge from the depths of the COVID-19 Pandemic, there is a high probability hospital business models will change. Review HSG’s observations on the six biggest strategic implications.

-

COVID-19 and Your Employed Physician Network (Checklist)

Review HSG’s COVID-19 pandemic checklist of short and long-term clinical and operational, financial, and strategic areas of evaluation.

-

Press Release – HSG Publishes COVID-19 Employed Physicians Checklist

HSG Publishes COVID-19 Employed Physicians Checklist to Address Clinical and Operational, Financial, and Strategic Implications for Health Systems