|

Download a PDF copy to share with your team |

INTRODUCTION

During 2019, we worked with more than 50 employed physician networks developing provider strategies, including designing provider compensation plans and addressing performance improvement opportunities. We interviewed hundreds of providers, administrators, and board members. We analyzed millions of data points related to productivity, financial performance, and patient interactions. We conducted surveys to understand perceptions around network and provider need.

As the year came to an end, we looked back on all this accumulated data in an effort to identify commonalities, key trends, and the most relevant findings. This article summarizes those findings and describes seven key takeaways that will be vitally important to successful employed provider networks in 2020.

|

|

Although not a new trend, we find there is increased scrutiny of employed group financial performance as administrators and board members are continuing to adjust to the increased importance of ambulatory operations. Concern about financial sustainability was especially notable in HSG’s Network Assessment Survey, a 26-question survey designed to assess perceptions of employed network performance. Out of the hundreds of provider, administrator, and board member respondents, only 25% believed their group’s financial performance is sustainable. This is somewhat unsurprising when analyzing financial data; the median loss per provider is approximately $114,000 for Medical Group Management Association (MGMA) hospital-owned practices and higher for the organizations we analyzed.

In 2020, successful organizations will evaluate opportunities to improve financial performance by assessing production, revenue cycle processes, and expense structures. Read more about improving financial performance in our White Paper “Creating Financial Sustainability – Identifying Drivers of Poor Financial Performance.”

|

|

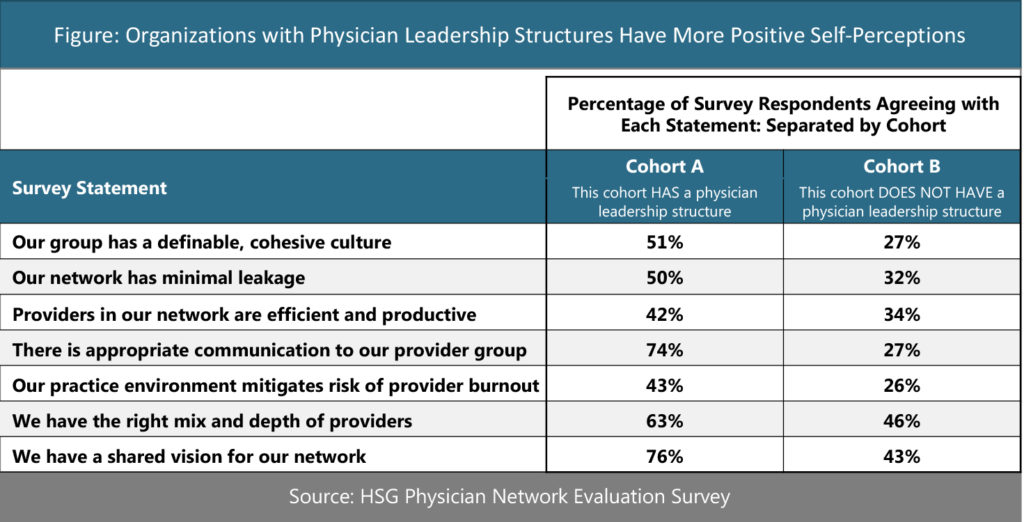

In the HSG Physician Network Evaluation Survey, 51% of respondents indicated an existing physician leadership structure, such as a physician advisory council. These councils allow for providers to have input into group operations and ownership of group performance. The effectiveness of such councils is evident when analyzing the HSG Network Assessment Survey data. The respondents who indicated having a physician leadership structure showed overwhelming more positive perceptions of their organizations as compared to those who do not indicate having a physician leadership structure. Details are found in the table below:

Any organization who does not already have a physician leadership council should consider developing one in 2020. For more information, check out our White Paper “Dyad Management and Leadership Councils in an Employed Network.”

|

|

In the HSG Network Assessment Survey, only 49% of physicians and 37% of APPs agree that their compensation methodology provides the correct incentives. We find this to mirror opinions when speaking in-person with both providers and administrators across the country. As the healthcare environment continues to move toward value-based reimbursement, many organizations are seeking to add non-productivity incentives to provider compensation.

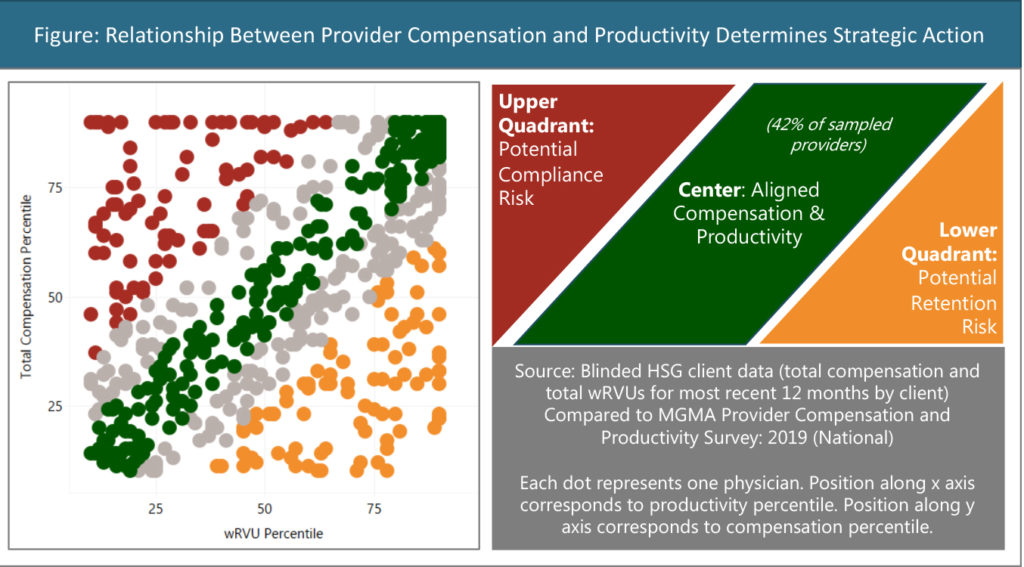

This is particularly important as productivity is still the primary driver in most compensation plans. When reviewing productivity and compensation data for more than 1,000 providers across more than 15 representative clients, we find that 42% of all analyzed providers have a total compensation amount that is within 10 percentile points of work relative value units (wRVUs) productivity when both are compared to MGMA benchmarks. One key strategy for success in 2020 will be for organizations to find the proper balance between productivity and non-productivity-based incentives.

Another key consideration will be for organizations to address providers in which there is a disconnect between compensation and productivity. If a compensation plan allows for productivity to unreasonably exceed compensation, it may be difficult to recruit and retain providers. On the other side of the spectrum, providers receiving compensation that is significantly higher than productivity represent FMV/compliance risk. These providers may require a formal opinion regarding the fair market value of their compensation. Addressing these issues is important for 2020 and beyond.

|

|

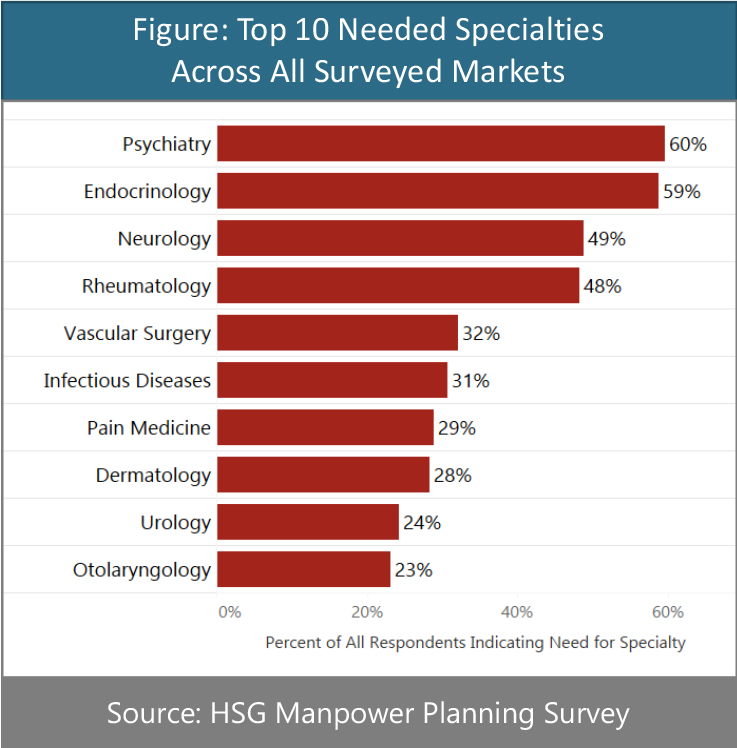

Patient access was a critical issue in 2019 and will continue to be relevant in 2020. HSG conducted a number of manpower planning projects last year and surveyed many providers across a variety of markets using the HSG Manpower Planning Survey. This survey asks practicing physicians to assess the need for incremental physicians across all relevant specialties. Through this survey, providers indicated an overwhelming need for primary care with 80% of respondents indicating a need for additional primary care physicians in their respective markets.

In addition to primary care, there are a number of medical and surgical specialties that commonly needed. The figure below shows the most needed specialties as indicated by responses gathered in the HSG Manpower Planning Survey.

Lastly, succession planning will be a key issue in 2020. In the HSG Manpower Planning Survey, 22% of all respondents said they intend to stop practicing in their market within the next five years.

Organizations wishing to take a holistic view when developing manpower strategies should check out our White Paper “Physician Manpower Planning – 12 Core Questions to Consider In the Age of Employment.”

|

|

Pressure on financial performance is causing many organizations to seek revenue enhancement and evaluate cost structures. Simultaneously, these organizations want to improve access to care within the communities they serve. Almost all of our clients are turning to advanced practice providers (APPs) such as nurse practitioners and physician assistants to help address these issues.

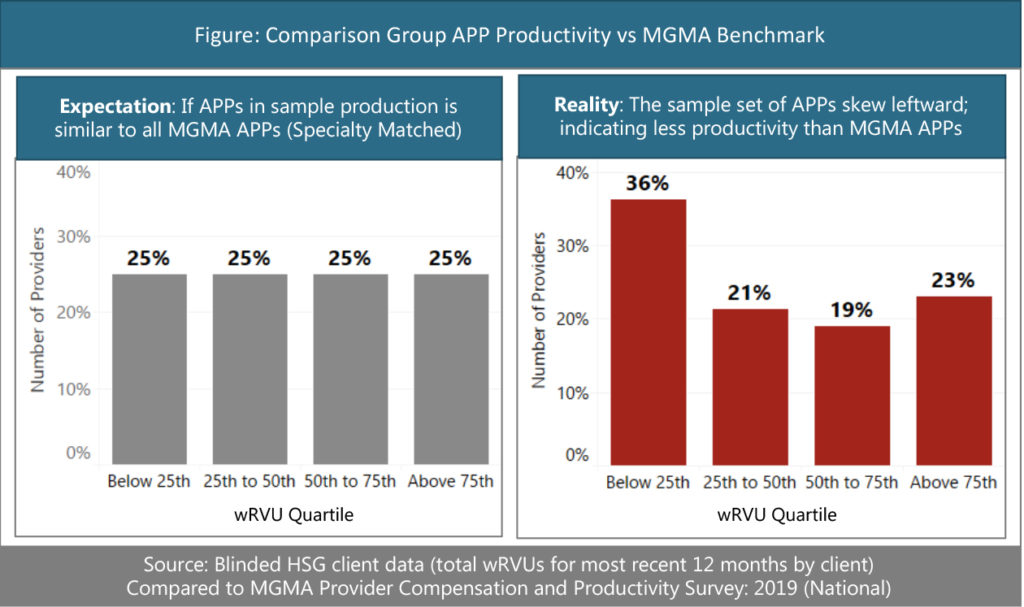

When used effectively, APPs can provide cost-effective care ultimately benefiting both patients and health system employers. Many of our clients, however, are still struggling with how to best incorporate APPs into their practice models. Without the right cultural and operational elements in place, APPs may not be utilized effectively and therefore unlikely to produce the previously mentioned benefits.

This is apparent when analyzing data for a group of clients that have employed APPs without a proactive strategic approach or sufficient operational infrastructure. Despite making up 32% of the provider FTE workforce in these organizations, APPs only generate 17% of total wRVU production. These APPs are also underutilized compared to their peers in MGMA survey data. This is shown in detail in the figure below:

One key issue for 2020 will be for organizations to develop the competencies required to ensure these providers are utilized effectively in providing care at the top of their licenses. Learn more in our Article “Incorporating NPPs Into Patient Care Delivery.”

|

|

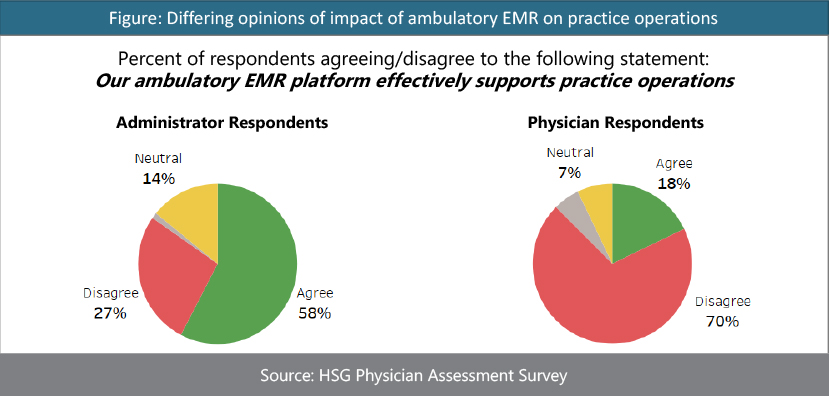

It is obvious that some providers dislike electronic medical records. Despite those providers’ aversions, we have observed many organizations where an inefficient EMR actively disrupts practice operations. This is one of the most consistently observed issues in the HSG Practice Assessment Survey, with 44% of all respondents disagreeing when asked if their EMR supported practice operations. This is also the most polarizing question, with perspectives varying greatly based on the role of respondent. As shown in the figure below, physicians are far more likely than administrators to identify operational issues with their EMR systems.

Our work with on-site practice assessment and improvement projects supports the findings above; many organizations have room for improvement in the use of ambulatory EMR systems. For more information check out our Article “Common Problems With EMR Optimization In Employed Provider Networks.”

|

|

We have said multiple times that the financial performance of employed physician networks will be a hot topic in 2020 and beyond. However, we believe it is also important to consider the cost and performance of contracted hospital-based services. In recent years, the cost of hospital-based contracts has not received the same level of scrutiny as employed losses. We expect this to change in 2020 as we have observed an uptick in the number of organizations asking for assistance in evaluating their hospital-based contracts.

An analysis of almost 40 projects dealing with contracts for anesthesia services, for example, shows an average subsidy per anesthesia provider of around $80,000. There is, unsurprisingly, significant variation around this average but a proper assessment can help an organization evaluate opportunities around renegotiation, re-bidding, or bringing the services in house.

For more information specifically about evaluating hospital-based subsidies, contact Neal Barker.