OVERVIEW

Traditional Primary Care Offices and Urgent/Immediate Care Clinics are one of the main access points into any health system. Comprehensively understanding the share of that market being capture, and the ancillary services captured from each practice/provider is critical to outpatient growth. Measuring Primary Care Market Share and identifying revenue opportunities is crucial.

HSG’s Insights to Action Methodology helps clients navigate this process by analyzing primary care office visit data, identifying gaps in services, and developing strategies to capture these opportunities, including ancillary services. Read below to learn how this approach ensures accurate market share assessment and effective revenue growth strategies.

CHALLENGES

In order to understand your Market Share and identify downstream revenue opportunities you must first define your markets. This poses the challenging question: How are we categorizing the providers in our market place?

Providers can be grouped in a multitude of ways including:

- Office Location / Service Area

- Practice Type or Service Line

- Specialties / Sub-speclaities

The next challenge comes in knowing which sources are best for comprehensively measuring the market for comparison to other hospitals and health systems. While this may seem straightforward, the way you define your markets may not be aligned to how others define theirs. Having a trusted partner to help find, validate, and analyze the market can make the process faster and less frustrating.

APPROACH

HSG’s Insights to Action Methodology takes clients through six key steps to identify problems and create long-lasting solutions.

To accurately identify your current Primary Care Office Visit Market Share and future opportunities, HSG’s data analytics experts:

- Analyze market share data for primary care office visits: Use proprietary claims-based data sets and analytical tools to assess the percentage of primary care visits captured by your organization compared to competitors.

- Identify revenue opportunities from other primary care providers: Look for gaps in services offered by competitors and work with your team to develop strategies to fill those gaps.

- Develop strategies to capture these opportunities: Implement marketing and business development targeting campaigns, partnerships, or new service offerings to attract more patients to your primary care offices for visits.

We also look at Ancillary Services capture to further your understanding of the market, which requires a similar approach:

- Identify key ancillary services to capture: Determine which ancillary services (e.g., lab tests, imaging) are most in demand and have the highest revenue potential.

- Develop strategies to capture outpatient services: Create referral programs, partnerships with outpatient facilities, or in-house services to capture these services.

- Analyze the downstream impact of these services from primary care access points: Track the increase in revenue and patient attraction resulting from the capture of ancillary services.

DATA ACQUISITION

What data do we aggregate to solve the problem?

HSG leverages a few key data sets when evaluating Primary Care Provider Market Share:

- HSG proprietary all-payer claims database (inclusive of FFS Medicare and Commercial claims)

- HSG proprietary specialist categorization methodology based on actual claims submissions by provider. We believe this to be more accurate than publicly available datasets via NPPES or other sources.

- Service area and geographic information specific to the health system market

- Health system practice and provider detail for primary care providers.

- Including productivity measures by provider is often a data element that is valuable to layer in when evaluating overall access, but not required for market share measurement.

DATA TRANSFORMATION

How do we extract information from the data?

To create a cohesive and robust view of Market Share, HSG transforms data set by following several best practices:

- Combine various data sets from different sources through the use of data analytics tools and techniques like data mining, machine learning, and statistical analysis.

- Ensure data quality and accuracy by implementing data validation and cleaning processes.

- Create unified nomenclature to standardize terminology and ensure comprehension and consistency.

- Develop data visualizations using tools like Tableau or Power BI to make-to-understand reports.

PROFESSIONAL SERVICES

What expertise do we apply to find a solution?

HSG applies it’s data analysis expertise to market share information to help clients:

- Understand market share and identify any trends and opportunities for growth.

- Review claims utilization and provider processing to assess provider performance.

- Develop strategies to capture data from identified regions and implement targeted marketing campaigns or outreach programs in these areas.

- Ensure data stays relevant and useful through regular updates.

PACKAGING

How do we structure and apply our expertise?

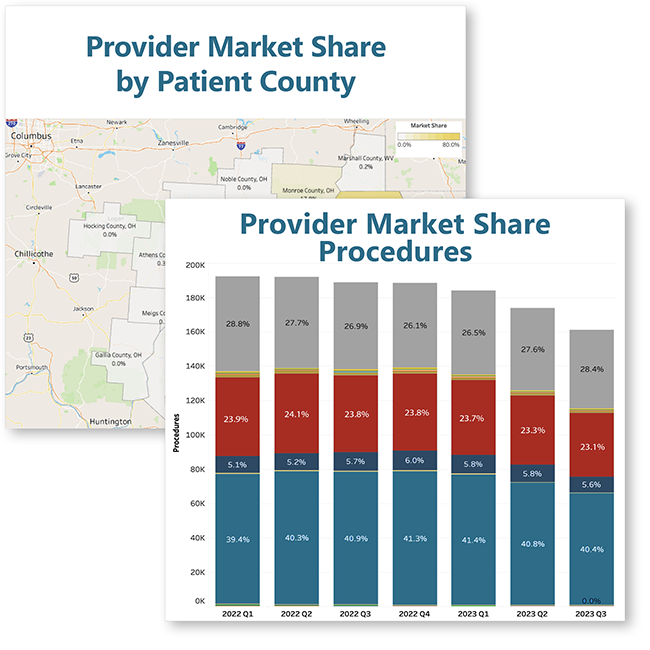

We utilize data analytics tools like Tableau or Power BI to create unique visualizations know as Workbook Solutions for each data set, which clients are able to access and interact with through HSG Dashboard.

When developing the visualizations, we identify several different data points to review, each of which requires a unique analytical approach to thoroughly uncover its impact on the organization’s overall Provider Market Share.

Examples of different data points and unique analysis include:

Geographical Focus

Determining the specific geography of interest, such as Lexington, KY, in the sample market.

Identify key regions within this geography: Analyze patient address data to determine where most visits are coming from.

Develop strategies to capture data from these regions: Implement targeted marketing campaigns or outreach programs in these areas.

Specialty Focus

Identifying the specialties of interest, such as cancer or primary care providers, and understanding their market share.

Analyze market share data for these specialties: Use data analytics tools to assess the market share of different specialties.

Identify key specialties of interest: Use data analytics tools to identify which specialties have the highest demand and revenue potential.

Provider Identification

Recognizing the actual primary care providers, including physicians and advanced practice providers, servicing patients in the market.

Develop strategies to engage with these providers: Implement outreach programs, partnerships, or incentives to engage with primary care providers.

Identify primary care providers: Use provider directories and claims data to identify primary care providers.

Analyze data to understand their impact on the market: Use data analytics tools to assess provider performance and market share.

Evaluation and Management Capture

Analyzing office visit or evaluation and management capture for the specific market area.

Ensure data accuracy and relevance: Regularly update and validate the data to ensure it remains accurate and relevant.

Analyze office visit data: Use data analytics tools to assess the volume and types of office visits.

Develop methods to capture evaluation and management data: Implement data collection processes and tools to capture this data.

Ancillary Service Capture

Determining which ancillary services (e.g., lab tests, imaging) are most in demand and have the highest revenue potential.

Develop strategies to capture outpatient services: Create referral programs, partnerships with outpatient facilities, or in-house services to capture these opportunities.

Analyze the downstream impact of these services from primary care access points: Track the increase in revenue and patient satisfaction resulting from the capture of ancillary services.

DELIVERY

When and how do you receive solutions?

During the delivery of our findings, you will receive a report in PDF or PowerPoint for easy review and sharing throughout the organization to key stakeholders.

- Reports typically include data visualization snapshots and suggestions of trackable key performance indicators (KPIs) to begin tracking.

Clients also gain access to their complete data, developed as interactive, digital Workbooks in HSG Dashboard.

- Workbooks allow clients to review data a granular level, creating the ability to drill down from overall practice roll-ups to individual provider performance details.

- Workbooks also help ensure data accuracy and relevance through regular updates and validation efforts.

IMPLEMENTATION & MONITORING

How do we provide ongoing support to your organization?

In order to create the best chance for continued success, HSG believes that developing- and following- a structured data evaluation process, tailored to the organizational needs.

Process Steps could include:

- Streamlining data collection, analysis, and reporting to identify more tailored opportunities for growth.

- Regularly reviewing KPIs to help your team see real-time results for their efforts and track long-term progress.

- Continued Workbook and solutions customizations to fit the changing needs of the organization.

CONCLUSION

Understanding your Primary Care Market Share is vital for identifying lost revenue and growth opportunities within your healthcare network. By analyzing internal services and provider performance, healthcare organizations can uncover areas for improvement and develop strategies to enhance patient retention and service delivery. Leveraging HSG’s data analytics and methodology, organizations can make informed decisions to optimize their primary care services and strengthen their market position.

When you’re ready to gain back your market share, reach out to DJ Sullivan, and learn more about HSG Advisors’ core services through our LinkedIn page.