Robust Healthcare Service Line Analytics Are Critical For Proper Planning

An exceptional hospital service line allows a hospital or health system to better serve its patients and differentiate itself in the market. Building such strong service lines requires careful planning that addresses physician capabilities, operational efficacies, market factors, accessibility, and integration of care models.

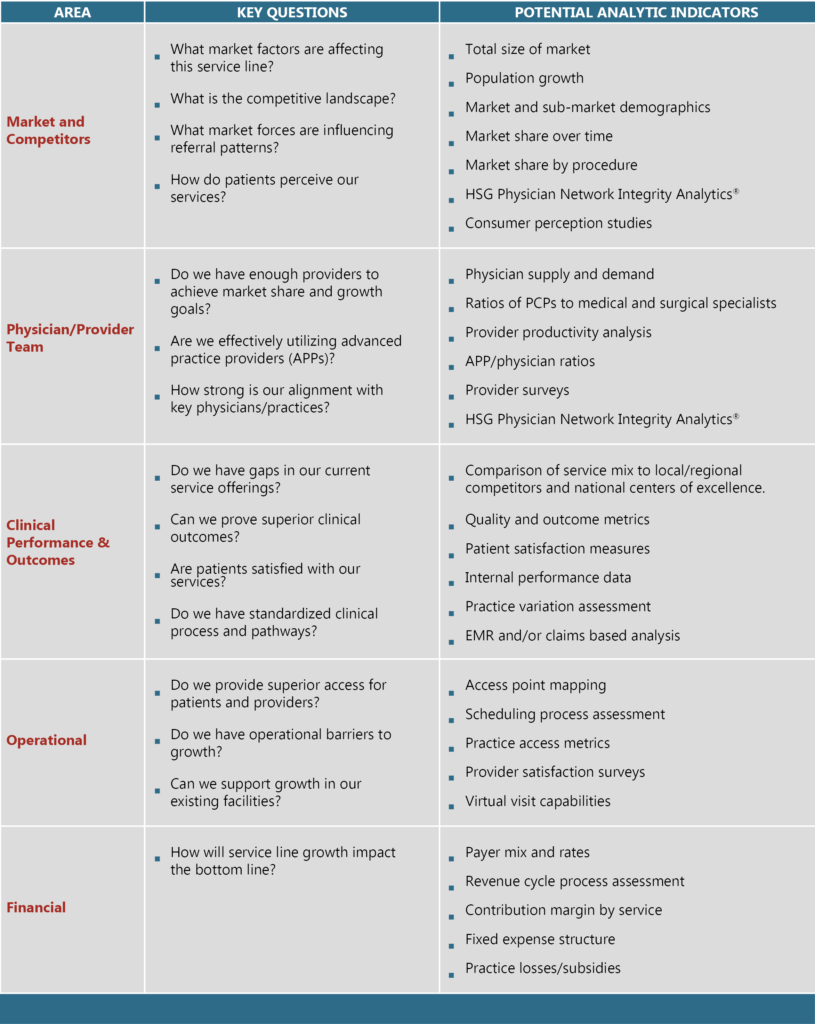

Although there are many elements that go into effective service line planning, this article focuses on the data and analytics required to build superior service lines. After all, great decisions are driven by reliable and well-presented data. This is especially true when disparate information is needed to understand the whole picture. This is the case in service line planning which requires understanding of the market, competitors, and internal operations including inpatient, outpatient, and physician practice components. Consider the following diagram, which consolidates relevant questions and metrics from a variety of areas.

5 Service Line Planning Areas of Emphasis

Case Study Examples Resulting from Proper Utilization of Healthcare Service Line Analytics

Case Study Example One

An independent community hospital in the Midwest sought to improve its already strong cardiology service line which was driven by its group of employed cardiologists.

Analytic Findings

- Each of the employed cardiologists and APPs were producing wRVUs above the 75th percentile

- Claims-based HSG Physician Network Integrity Analytics suggested that the employed primary care providers were highly loyal but patients from independent providers were more likely to out-migrate to the larger, regional system. Qualitative investigation suggested this was due to potential access issues.

- By comparing population-based demand models and an inventory of physicians and APPs in the market, we conclude there is need for general and interventional cardiologists. Demand for electrophysiology was already being met.

- Operational metrics indicated additional staff and space would be required to support volume growth.

Strategic Direction and Results

Client leadership recognized that additional provider resources were required to drive volume growth and service expansion. As a result, a significant emphasis was placed on physician recruitment. Additionally, the client expanded its satellite clinic program to alleviate space constraints and enhanced practice staffing resources to improve scheduling and appointment availability. A business development program was initiated to reach out to independent primary care providers, introduce the newly recruited cardiologist, and address access concerns. The client has also expanded cath-lab capacity and experience significant growth as a result of these efforts.

Case Study Example Two

During its regular strategic planning process, an independent hospital in the South identified significant opportunities to strengthen its primary care base. As a result, special strategic emphasis was placed on developing a primary care service line strategy.

Analytic Findings

- Provider supply and demand analysis indicated a need for additional PCPS, with some portions of the market severely undersupplied.

- There was inconsistent geographic dispersion of primary care providers; a large portion of the market’s population did have not have convenient access to a primary care practice location.

- Provider age analysis indicated potential for imminent succession planning issues.

- Market share analysis showed consistent downward trend across multiple key service lines with outmigration to regional metropolitan area.

- Claims-based HSG Physician Network Integrity Analytics identified opportunities to decrease patient leakage from primary care to specialty providers.

Strategic Direction and Results

Client leadership developed an aggressive primary care recruitment strategy with total number of primary care providers increasing from 18 to more than 70 over a 5-year period. Practices were better distributed based on market demographics. Focus on referral patterns identified and addressed key drivers of outmigration. As a result, total health system revenue grew by 75% over the same 5-year period. This improved financial footing has allowed the hospital to upgrade facilities and recruit additional specialists, further reducing patient outmigration.

Case Study Example Three

A small system in the Southeast sought to identify opportunities for growth in the cardiology service line where most volume came from two independent cardiology groups.

Analytic Findings

- Supply and demand analysis suggest very minimal net need for medical cardiology and a slight oversupply for interventional cardiology.

- Service line revenue stable but cath-lab profitability has been decreasing due to rising supply costs.

- Quality measure analysis suggests opportunity for improvement in key outcomes areas, particularly median minutes to immediate PCI for STEMI patients as measured by the National Cardiovascular Data Registry (NCDR).

- Market share analysis suggests opportunity for growth, with cardiology market share underperforming most other specialty services by 10% – 20%.

Strategic Direction and Results

The client initially preferred to recruit and employ new incremental cardiologists in order to more tightly control the provider compliment within the service line. However, after reviewing the analytic findings it was concluded that such recruitment was not prudent due to lack of market demand. Any new physician would either 1) fail to ramp up; or 2) ramp up at the expense of the independent groups, which would likely impact overall service-line volume.

The client, therefore, decided to engage the independent groups in a co-management arrangement which provided incentives for managing and improving the service line. Specifically, the agreement included NCDR metrics and a supply-cost metrics, both of which improved significantly during the first year of the agreement. These improvements resulted in better outcomes and a better bottom line, both of which were leveraged into marketing efforts to further increase volume and gain market share.

Contact Eric Andreoli to learn more about HSG’s Approach to utilizing healthcare service line analytics in your service line development planning.

|

Download a PDF Version of the Article to Share With Your Team |

Related Service Line Analytics Resources

Developing a strategic Physician Manpower Plan that considers the strategic needs of a health system, as well as the existing competitive dynamics, is one of the most important things health system leadership can do to ensure revenue targets will be hit. Utilizing analytics appropriately throught that process is critical to the success of the effort. Read this past article from HSG Managing Partner Travis Ansel on improving your physician manpower planning but utilizing patient-focused claims data analytics.

Lastly, if you are in the development and planning stages for a longer-term service line level strategic plan, review this checklist to ensure you are comprehensively evaluating relevant categories of analysis.