Download the entire PDF article, or read below:

Introduction

In January 2023, HSG Advisors (HSG) launched its “2023 Provider Compensation Survey.” This short, ten (10) question survey asked healthcare leaders and provider compensation professionals around the country for their perspectives on several topics affecting physician and advanced practice provider (“APP”) compensation.

Subsequently, HSG has produced four (4) articles based on the results of the survey (click here to access all four). To this point, the articles have covered topics and issues such as the types of compensation models in the marketplace, the preponderance of Work Relative Value Unit (“wRVU”) compensation models, the impact of COVID-19 and the 2021 Medicare Physician Fee Schedule (“MPFS”) changes, adoption of the 2021 MPFS wRVU values, 2023 coding and documentation changes, changes in split/shared visit requirements, and the use of nonproductivity incentives in provider compensation models. This fifth (5th) and final article speaks to the survey’s questions related to fair market value and commercial reasonableness concerns and determination.

Background

The impetus for our desire to ask these survey questions was two-fold:

-

- The first driving factor was COVID-19 and the 2021 MPFS wRVU changes and the disruptive impact these monumental events had on the industry surveys that so many compensation professionals rely on for fair market value determinations.

-

- The second catalyst was the Stark Law (“Stark”) and Anti-Kickback Statute (“AKS”) updates and clarifications that took effect in early 2021.

Even though two (2) years have passed since the release of the Stark and AKS updates and the release of the 2021 MPFS and nearly a full year has passed since the country’s “emergence” from COVID-19, we appreciate the significant and lingering impact of these events, which are compounded by health care organizations’ variable adaptation to them. These circumstances mean they are still playing a direct, though evolving role in thought processes surrounding the evaluation of provider compensation for fair market value.

Fair Market Value Concern

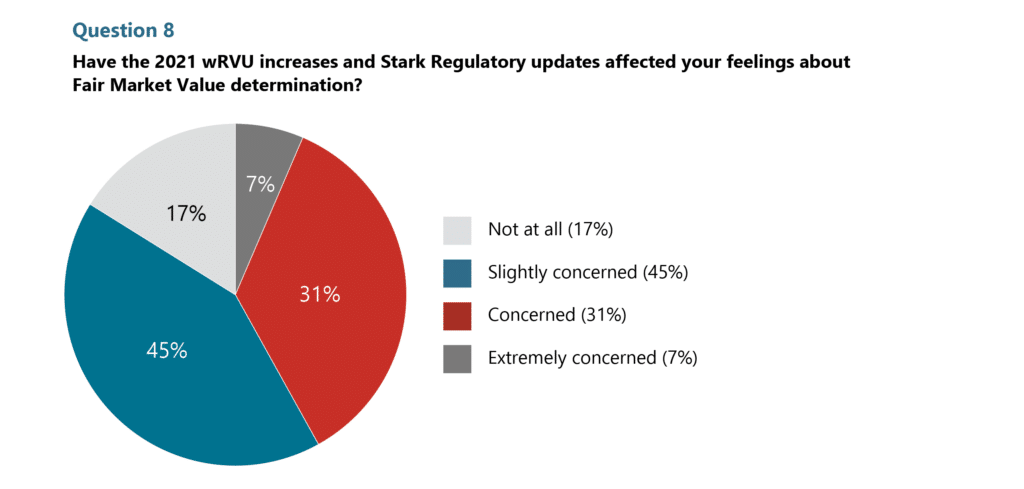

The first question we asked related to fair market value was Question 8,” Have the 2021 wRVU increases and Stark Regulatory updates affected your feelings about Fair Market Value determination?” Respondents were asked to rate their level of concern as “Not at all,” “Slightly concerned,” “Concerned,” or “Extremely concerned.” Approximately 17% indicated that they were “not at all” concerned about how the wRVU increases and Stark changes were affecting their feelings about fair market value determination. Everyone else responded with some level of concern. Only 7% were “extremely concerned,” 31% were “concerned,” and 45% were “slightly concerned.” Clearly, the changes have leadership’s attention, but it doesn’t appear that the respondents are losing much sleep because of the changes.

A great follow-up question would have been “Which of the two—wRVU increases or Stark changes—weigh most heavily in your mind and in your response?” We suspect, based on our interactions, discussions, and calls from clients, that the 2021 wRVU value changes are the more concerning of the two. While the Stark Law’s untangling of concepts and the clarification of the “Big 3” (fair market value, commercial reasonableness, and volume or value standard) was interesting and helpful in evaluating arrangements, and while attention may have also been drawn to CMS’s emphatic rejection of commenter belief that CMS policy was that all compensation below the 75th percentile is fair market value, we believe nothing grabbed the attention of health care executives as the potential to realize as much as a 30% increase in their providers’ wRVU-based compensation, literally overnight.

Over the past two (2) years we’ve worked with enough organizations to adjust their compensation per wRVU bonus rates and bonus targets to know that the wRVU value changes demanded leaders’ attention—both from a fair market value perspective and from a financial sustainability perspective. While the resulting adjustments recommended to bonus conversion factors and targets saved organizations from experiencing additional cost without a corresponding increase in revenue and mitigated fair market value and commercial reasonableness concerns, it did not fix some preexisting issues in organizations’ compensation structures—namely, the practice of utilizing median (or higher) compensation per wRVU rates for bonus conversion factors. (For more about this topic and advice about selecting the right rate, please see our first article in this series.)

Perhaps a second great follow-up question would have been “What policies, procedures, standards, and/or guardrails mitigate or assuage the fair market value concerns you might otherwise have?” In other words, what are you doing (or what have you done) that gives you confidence in your organization’s ability to mitigate risk and evaluate provider compensation for fair market value? We can’t help but think that many organizations have policies and procedures in place that provide confidence. While nothing is 100% certain, they feel they are doing the best they can and have legitimate safeguards in place.

External vs. Internal FMV Review

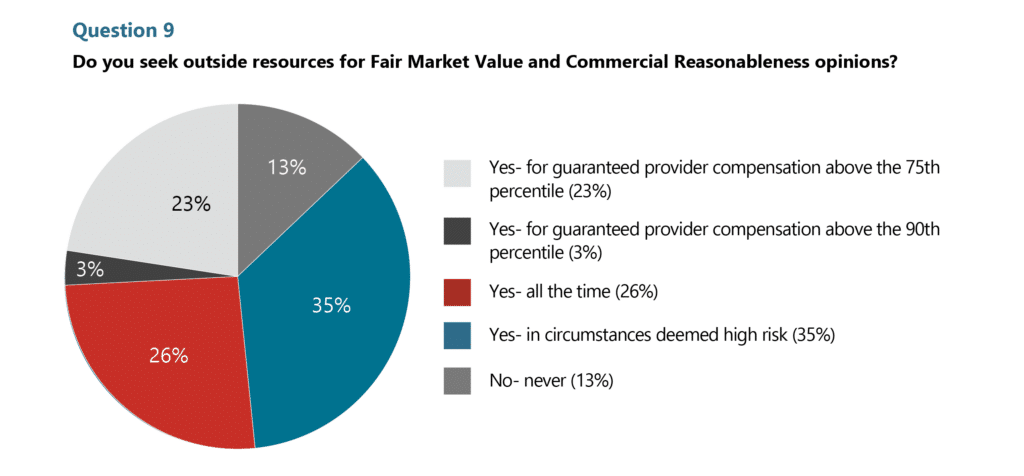

The next question regarding fair market value and commercial reasonableness we asked in the survey was Question 9, “Do you seek outside resources for Fair Market Value and Commercial Reasonableness opinions?” To this question, only 13% said, “No, never.” At the completely other end of the spectrum, 29% said, “all the time.” In the middle, 35% said, “Yes, in circumstances deemed high risk,” 23% said, “Yes, for guaranteed provider compensation above the 75th percentile,” and only 3% said, “Yes, for guaranteed provider compensation above the 90th percentile.” The last is likely only 3% because we believe very few organizations are going to allow base compensation to be at the 90th percentile, and if they do, it is only going to occur in rare and unique circumstances.

The option that garnered 35% responses is vague and open-ended, but it does indicate that beyond just guaranteed compensation at the 75th or 90th percentiles, a third of organizations surveyed do have standards and guardrails that define “high risk.” These standards and guardrails indicate recognition of the importance of compliance and that some provider compensation arrangements require specific external expertise and formal documentation of unique facts and circumstances. The importance here is to demonstrate commitment to compliance and implement checks and balances that provide true protection to mitigate an organization’s risk. Some standards and criteria triggering an external fair market value and commercial reasonableness opinion that we’ve encountered include, but are not limited to:

-

- Total cash compensation (TCC), which is compensation from all sources (i.e., base, production, nonproductivity, on-call, APP supervision, medical direction, etc.), is expected to be over the 90th percentile.

-

- If TCC percentile is anticipated to exceed production (i.e., wRVUs) percentile by more than ten (10) percentiles (or more than 10% once the 90th percentile is eclipsed) and is above the median compensation.

-

- Achieving a certain percentile of compensation per wRVU (i.e., the 60th percentile of compensation per wRVU).

-

- All compensation arrangements with independent physicians and/or independent groups, such as medical directorships, on-call pay arrangements, co-management, and hospital-based service and subsidy arrangements.

-

- Complex arrangements with relatively high compensation amounts, and/or a number of different components in which compensation stacking could be a concern (i.e., base, production, nonproductivity, on-call, APP supervision, medical direction, meeting attendance, and co-management), whether independent or employed arrangements.

-

- Special circumstances, such as contracts with a member, or family member, of the Board of Directors or with an officer, or family member of an officer, with the health system.

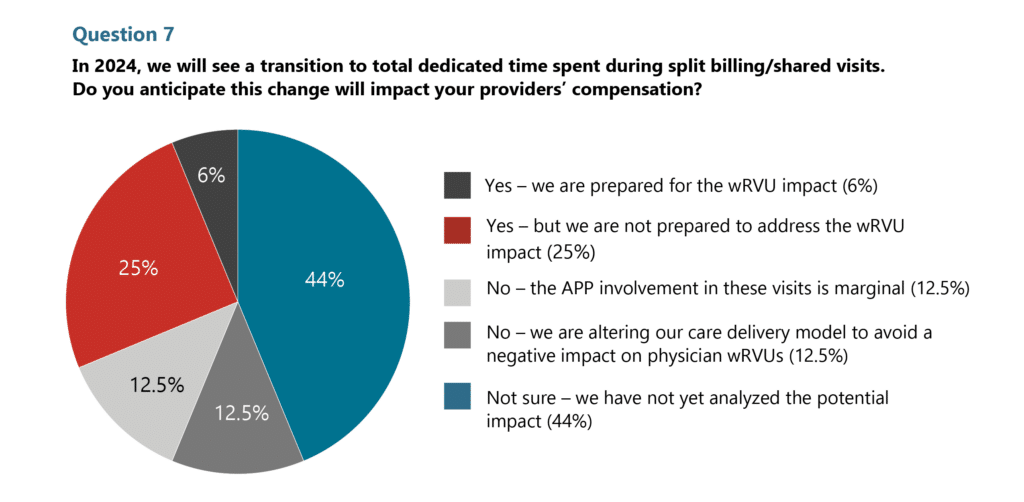

Lastly, we believe it is worth mentioning Question 7 of the survey, “In 2024, we will see a transition to total dedicated time spent during split billing/shared visits. Do you anticipate this change will impact your providers’ compensation?” Response to this question was discussed in great detail in our 3rd article of the series, “Split/Shared Visits – Major Issues Loom.” While 44% of respondents to this question said, “Not sure, we have not yet analyzed the potential impact,” we are confident that this event will have a significant impact on survey data (i.e., compensation, wRVU, and compensation per wRVU ratios) and fair market value determination in the future—perhaps not at the same level as COVID-19 and the 2021 MPFS wRVU value changes, but nonetheless a significant impact for specialties in which physicians and APPs work together in hospitals and nursing facilities (i.e., hospital medicine, critical care, cardiology, psychiatry, pulmonology, and neurology to name a few).

Just as we dealt with disruption, change, and a resetting of a new normal after COVID-19 and the 2021 MPFS wRVU value changes—the same will be true with the split/shared visit changes. [Note: The proposed 2024 Medicare Physician Fee Schedule intends to defer movement to time spent as the sole determinant for billing providers in 2024.]

Key Takeaways

-

- Fair market value and commercial reasonableness determination is not without its concerns and challenges, especially with all the changes we’ve dealt with over the past three (3) years.

-

- Most healthcare executives and provider compensation professionals have some relative level of concern for how they consider, evaluate, and document fair market value post-CMS’s Stark Law and 2021 wRVU value changes.

-

- We’ve found that adjusting wRVU conversion factors and bonus targets, as well as having fair market value policies and procedures in place, reduces many provider compensation professionals’ level of concern.

-

- Most healthcare executives and provider compensation professionals have some relative level of concern for how they consider, evaluate, and document fair market value post-CMS’s Stark Law and 2021 wRVU value changes.

-

- This may be a great opportunity to review your criteria, policies, and procedures for evaluating fair market value and commercial reasonableness, including criteria for obtaining an external third-party review. If your organization doesn’t have any, it is a great time to establish them. If you have criteria, it might be a good time to reevaluate their relevance and effectiveness.

-

- Be aware of, and consider market and industry events that affect current survey data.