|

Download a PDF Version of the Article to Share With Your Team |

Patient Attraction vs. Patient Retention Strategies: Why Your Health System Need Both

Health systems continue to live in a predominantly fee-for-volume world while slowly transitioning towards a fee-for-value environment. The dynamics of trying to operate in two different environments produces a polarizing effect on patient growth strategies. Fee-for-volume is focused solely on attracting and pushing more patients through the system. Fee-for-value is looking to manage the care of a specific population in a more cost-effective and quality manner. To survive in both worlds, organizations currently need strategies to support each. Patient attraction strategies will support organizations continuing to thrive in today’s current fee-for-volume environment. Patient retention strategies support the latter.

Patient Attraction Strategies

There are five key components to an effective patient attraction strategy that need to be considered when evaluating how to attract new patients to your health system:

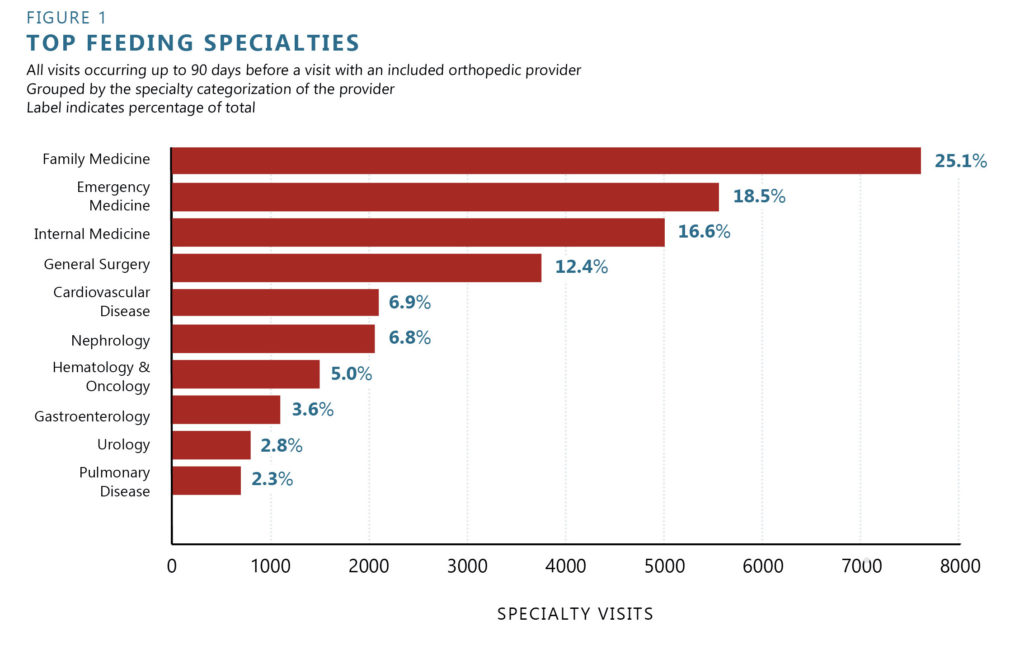

1: Referral Source Alignment – The most immediate opportunity for your health system to attract patients is by closely aligning with physicians and advanced practice providers (APPs) that are already sharing patients with your sites of service. Comprehensively evaluating current provider alignments and developing a strategy to tighten those relationships will support short- and long-term growth objectives.

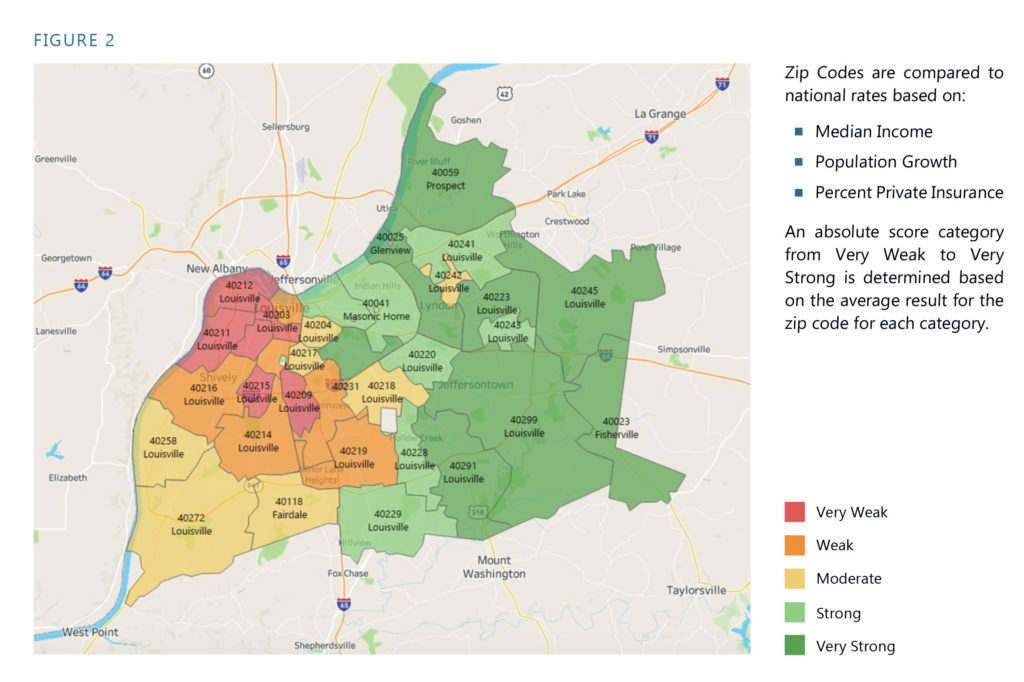

2: Market Attractiveness – Factors such as population size, population growth, household income, and percentage of residents with private insurance can provide valuable directional support for initial markets to explore expansion opportunities.

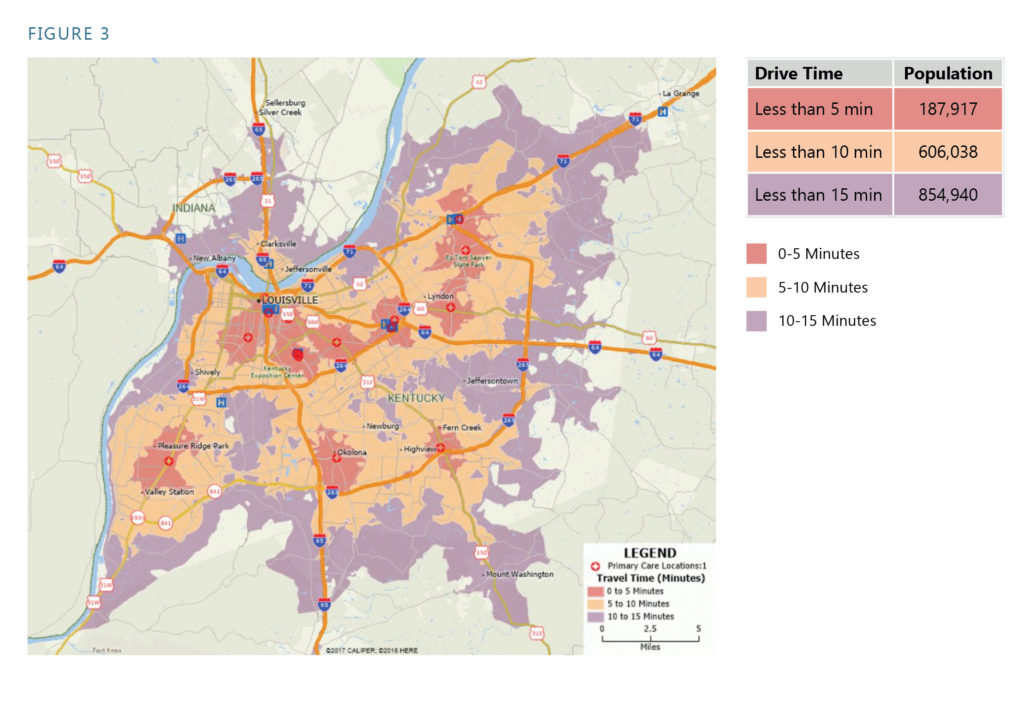

3. Patient Drive Time and Travel Patterns – Evaluating patient access to care and its impact on attracting new patients is beneficial. Patient drive times to hospital facilities, primary care, or specialty practices, along with other ambulatory service sites, may influence patient choices. Exploring high volume traffic areas, resident travel patterns, and tertiary orientation in specific markets provides guidance for areas of growth for a physician practice or ambulatory care access placement.

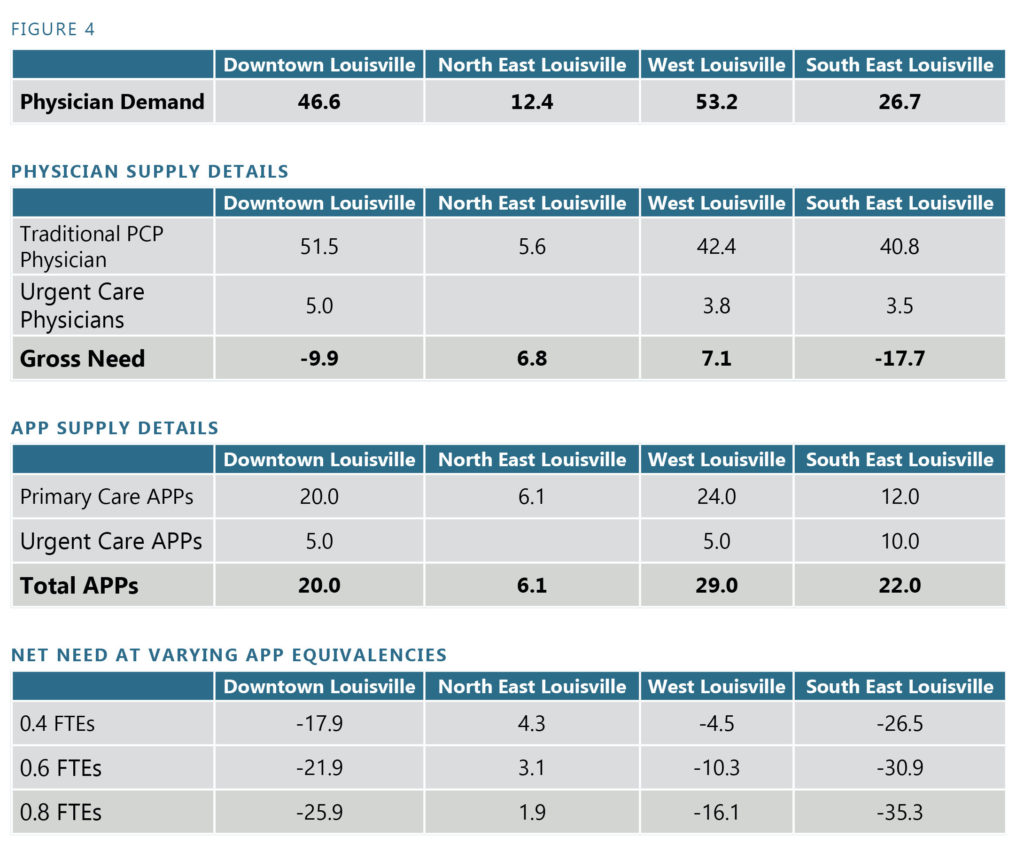

4. Primary Care Physician Need – Primary care need directly impacts your organization’s ability to build and sustain a new patient base within a market. Markets with a strong primary care need and the ability to draw incremental patient volumes from surrounding locations may be ideal for geographic expansion.

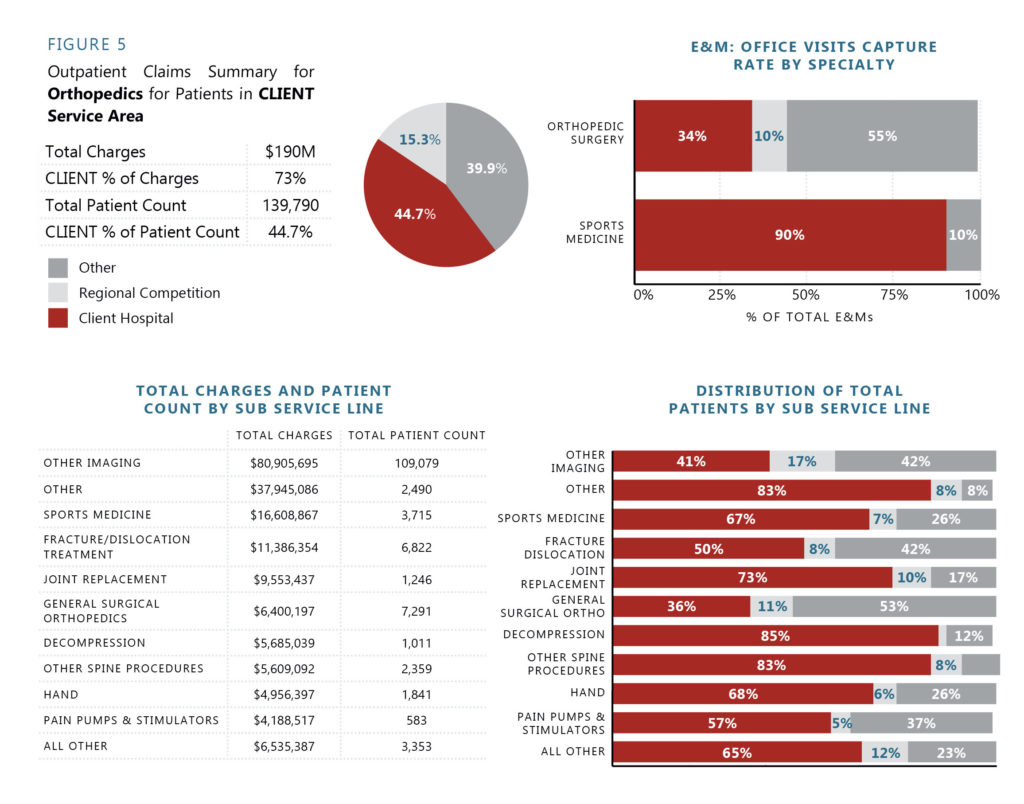

5. Market Share – Inpatient and outpatient market share analysis can classify service areas based on the greatest market change (positive or negative), potential patient growth opportunities, and overall market competitiveness. It can help you determine:

- What patient share your organization is currently losing that you should be winning.

- Which markets offer the largest opportunity for increasing your patient share and attracting new patients into your system.

Patient Retention Strategies

A patient retention strategy needs to be defined more specifically on the site of service in which patients are entering your system. By definition, the goal with patient retention strategies is to maximize the utilization of services for patients already touching your sites of care. These strategies differ by site of service. The three most critical entrance points to your health system that need to be addressed include:

1) Primary Care Patients – Patients utilizing your primary care physicians and APPs on a regular basis are inclined to be a more loyal patient base. These are traditionally patients that are willing to utilize services based predominantly on physician recommendations. Internal processes and workflows need to be optimized so that patients can easily remain within the system.

2) Emergency Department Patients – Emergency department (ED) patients are traditionally less loyal than primary care patients. There are often two key groups of patients utilizing the ED:

- Patients that are unsure of the appropriate site of service for their healthcare needs.

- Patients with true emergent care.

Building internal processes to educate the first grouping of patients about different sites of service and the capabilities within each while building internal follow-up plans for the latter patient group can provide opportunities to increase current capacities as well as simultaneously maximize your ability to retain patients.

3) Urgent/Immediate Care Patients – Urgent care patients are typically the least loyal of any of the patient cohorts defined. Urgent care patients are often the most educated on service offerings and most likely to shop around for healthcare services. Educating these patients while they are in your sites of care on your providers’ capabilities and skillsets can lead to fruitful returns over time.

As the healthcare ecosystem continues to evolve and shifts towards fee-for-value, but predominantly still remaining fee-for-service, your health system should have strategies to support the attraction and growth of new patients into your system while simultaneously retaining current patients to optimize the comprehensive care requirements they are receiving.