|

Download The Article to Share With Your Team Here |

2021 Physician Network Healthcare Trends

It has become an annual tradition at HSG to start the new year by reflecting on the healthcare trends, challenges, and opportunities presented by the prior year’s projects and clients. Despite the challenging and uncertain landscape of 2020, we continued our core work of helping employed provider networks develop manpower strategies, create provider leadership structures, update compensation plans, and improve healthcare system and hospital practice operations. Over the year, HSG analyzed millions of data points related to productivity, financial performance, and patient interactions. We conducted multiple surveys to understand perceptions around group effectiveness and provider need.

This article summarizes our findings from 2020 and highlights seven takeaways that will be vitally important to successful employed provider networks in 2021.

1) COVID will continue to impact strategy into 2021 and beyond.

At many points during 2020, healthcare organizations and hospitals were totally consumed by the immediate operational challenges created by COVID-19. Strategic initiatives often took a backseat to rolling out telehealth capabilities, managing ICU capacity, and now distributing vaccines. However, successful leaders know that strategy cannot be indefinitely sidelined and have been thinking about how the pandemic will impact organizational strategy in 2021 and beyond. Early in the pandemic, HSG sought input from more than 50 health system and practice leaders to understand their perspectives on how COVID-19 will affect strategic focus in the future. Unsurprisingly, their keen insights feel relevant months later as we think about planning for 2021. Specifically:

- Only 38% of respondents indicated they do not anticipate needing to make permanent changes to provider compensation due to COVID-19, which means approximately 60% of healthcare executives think they might need to reevaluate or redesign provider compensation.

- More than half of respondents believe they will need to change their employed group infrastructure due to COVID-19. The majority of healthcare executives who believe COVID-19 will impact their provider recruitment feel strongly that they will shift to employing MORE primary care advanced practice providers and FEWER medical and surgical specialists.

2) Employed provider groups will continue to address operational issues and progress toward value-based care.

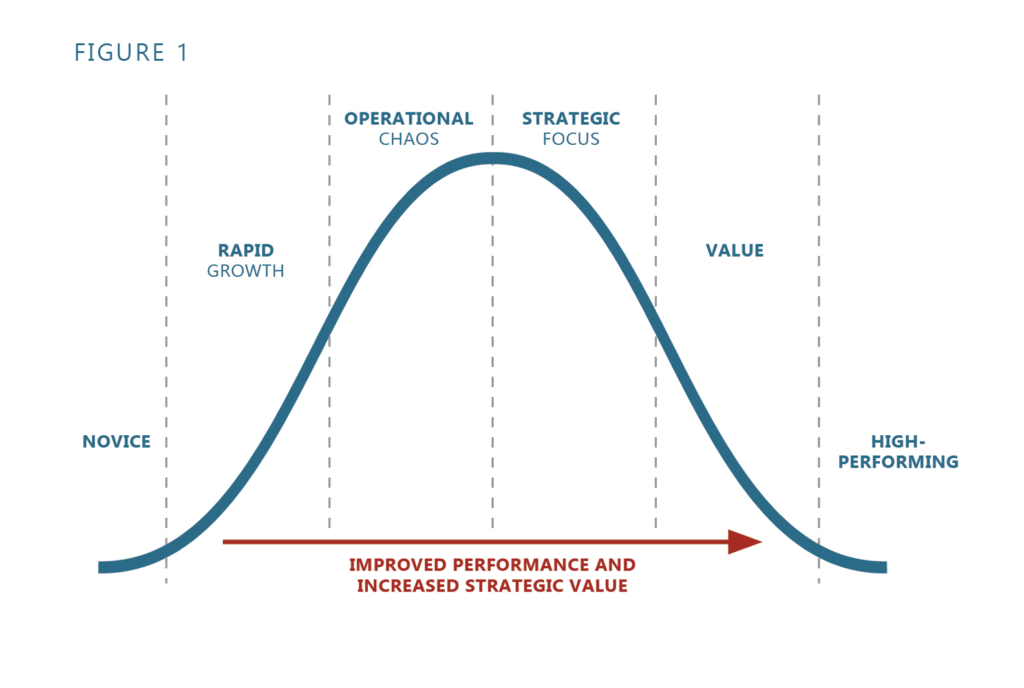

Despite the turmoil of 2021, our clients healthcare trends showed measurable progress along HSG’s Network Growth Curve. This framework is depicted in Figure 1 and identifies common challenges faced by hospitals and health systems as they 1) begin to employ providers; 2) rapidly acquire practices and recruit providers; 3) become overwhelmed by growth and face operational difficulties; 4) improve operations and begin to think strategically; 5) pursue value-based arrangements; and 6) become high-performing.

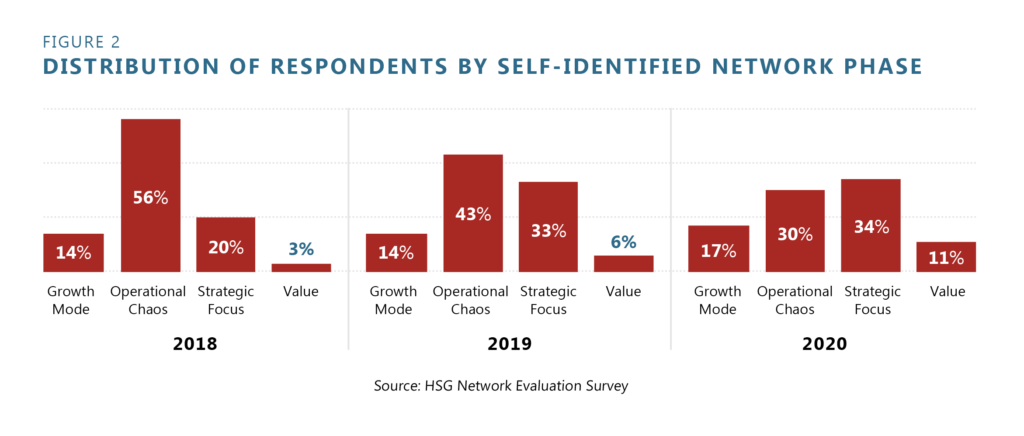

As part of the HSG Network Evaluation Survey, we questioned more than 1,000 employed group stakeholders to identify their organization’s growth phase. Figure 2 shows a continued trend of fewer groups in the operational chaos phase and more in the strategic focus and value phases.

We anticipate this trend continuing in 2021. Groups must strive to make progress along the network growth curve, or risk competition from more forward-thinking organizations in their market. Learn more about the HSG Network Growth Curve model here.

3) Development of cohesive group culture will drive progress for employed provider groups.

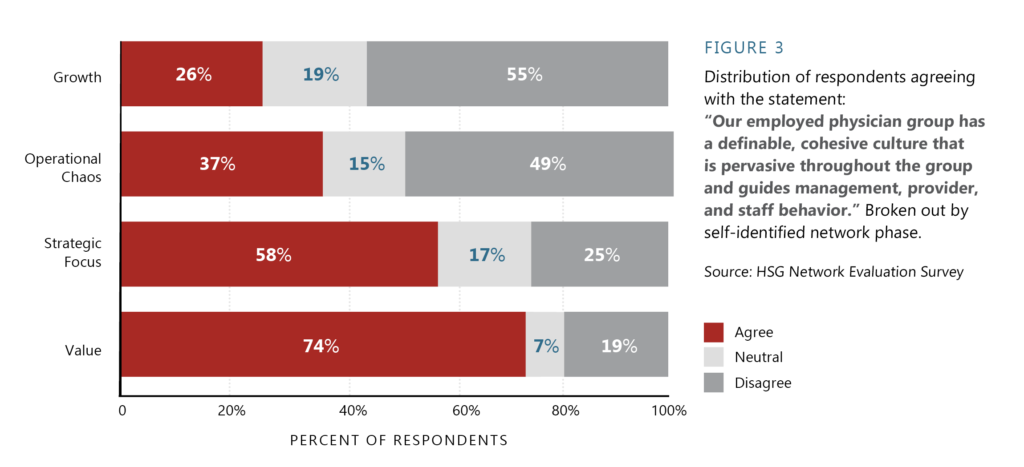

As many of our clients move into the strategic focus and value phases of the HSG Network Growth Curve framework, a unifying factor emerged. Groups who put effort into developing a cohesive organizational culture are more likely to emerge from operational chaos and progress towards high-performance. This fact is especially evident when we break down answers from the HSG Network Evaluation Survey. Figure 3 clearly shows that as organizations move through the growth phases, there is an increase in the proportion of respondents that agree their group has a cohesive culture. The correlation between an organization’s network growth phase and the respondent’s perceptions of culture is significantly stronger than the correlation with any other survey topic.

While it is tempting to assume cohesive culture results from improvements in other areas, our work with clients in this area demonstrates the opposite: a concerted effort to build culture is often a precursor to operational and strategic breakthroughs. For these reasons, a key healthcare trend in 2021 will be many networks bring together executives and providers to create a shared vision and develop a cohesive group culture. Click here to learn more about how HSG facilitates this process.

4) Organizations must leverage operational and cultural success to attract and retain patients.

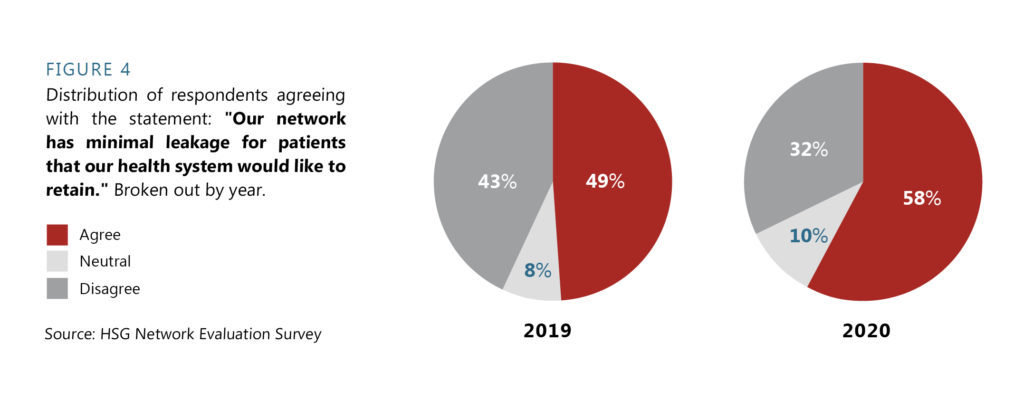

Attracting and retaining patients is essential across all phases of employed network growth. Patient volume is the lifeblood for organizations in fee-for-service environments, while value-based organizations must maintain tight control of care across the continuum. For these reasons, organizations have been intensely focused on patient capture and retention during 2020. Fortunately, many of our clients have increased keepage due to operational improvements and cultural development. This trend is observed in the HSG Network Evaluation Survey, where 58% of 2020 respondents agree that their network has minimal patient leakage. Figure 4 shows a substantial improvement over the 2019 response distribution.

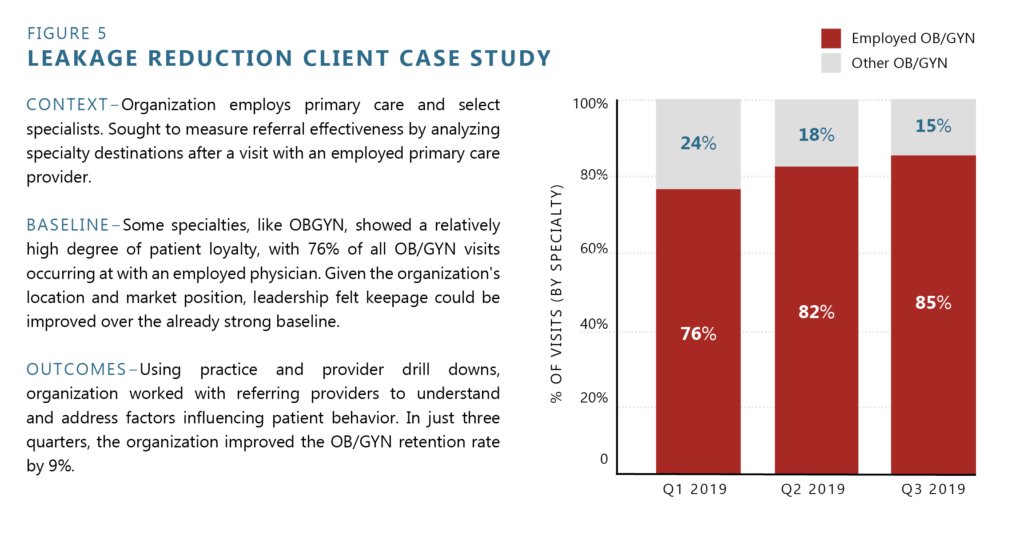

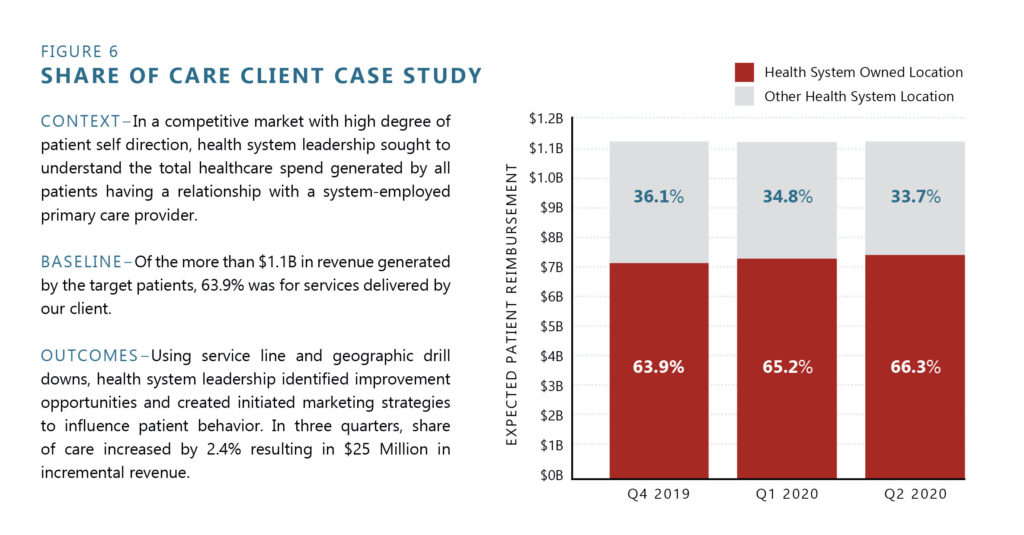

Improvements can also be measured directly using claims data via HSG Physician Network Integrity Analytics®. Figure 5 highlights an example from a rural community hospital that employs primary care providers and select specialists, while figure 6 shows data from a large health system with an academic flagship and more than ten community hospitals.

In 2021, organizations must develop strategies to monitor and improve patient retention. Learn more about HSG Physician Network Integrity Analytics® here.

5) Operational challenges will remain, particularly related to practice staffing levels.

It is important to note that emerging from operational chaos and into the strategic focus phase does not mean an organization is free from operational challenges. During 2020, healthcare trends suggested that many of our clients struggled to define and maintain the appropriate level of non-provider support staff. This was apparent in the HSG Network Evaluation survey, where only 37% of respondents agreed that their practice staffing levels were appropriate.

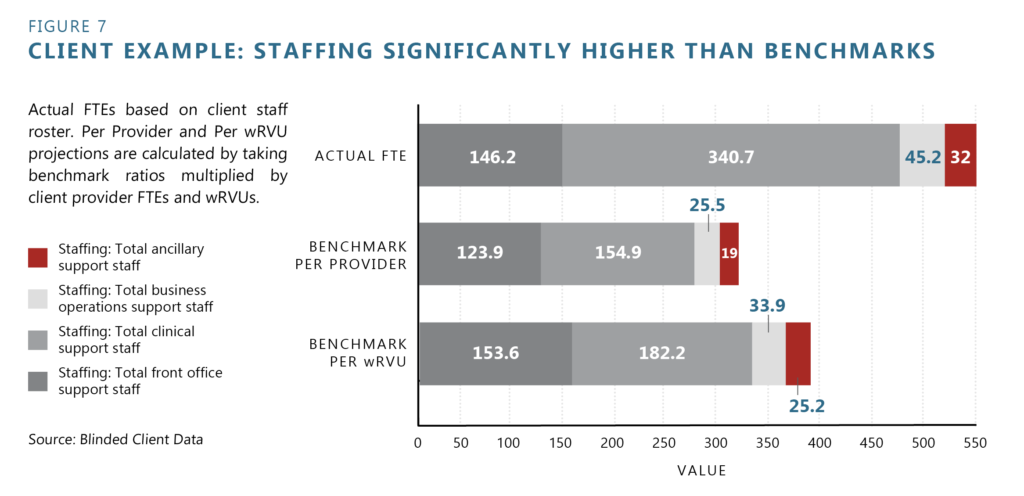

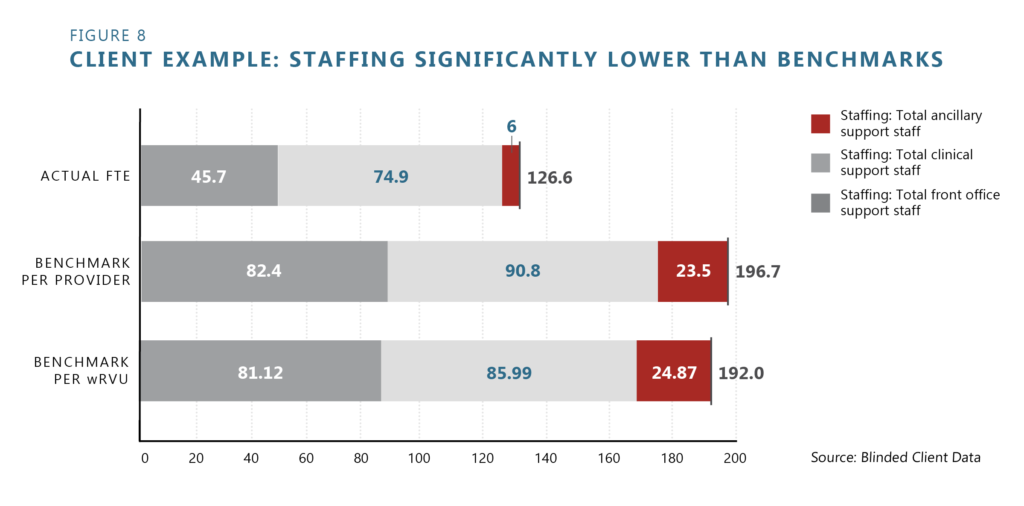

Challenges were also evident in our performance assessment and improvement projects. Figure 7 on the next page shows blinded data from a client having significantly more staff than our benchmark, even when adjusted for productivity. Inflated staffing can threaten financial sustainability or reduce the ability to reinvest in the group’s improvement. Figure 8 shows data from a client having significantly lower staffing levels when compared to the appropriate benchmark. Practices in this situation may be creating issues around access, productivity, or staff burnout. Interestingly, there are many similarities between these two groups, including size, provider mix, and market dynamics. These examples underscore the difficulty in determining and maintaining appropriate staffing levels.

For organizations seeking operational improvements in 2021, we recommend a thorough evaluation of practice staffing levels. We anticipate these efforts will identify tangible opportunities for improvement. Learn more about how HSG works with clients to identify staffing issues as part of our 10-week improvement plan.

6) Access to primary care and key specialties will remain a challenge, and many organizations will rely on APPs to close the gap.

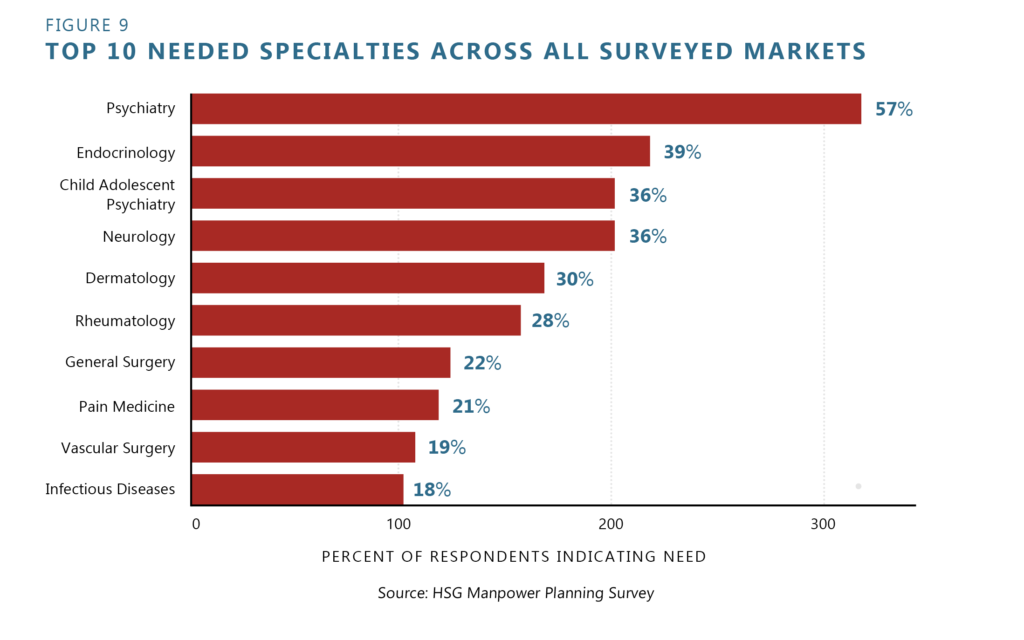

In the HSG Manpower Planning Survey, 72% of all 2020 respondents indicated a need for additional primary care in their market. These data are consistent with prior years, and we certainly expect this healthcare trend of continued need for primary care to be felt in 2021 and beyond. Additionally, there was a familiar group of medical and surgical specialties selected by respondents as the most needed within their markets. These are shown in Figure 9.

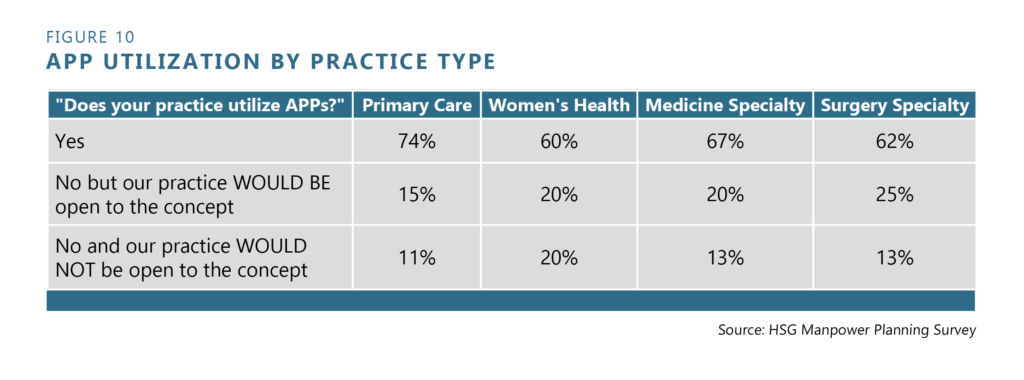

With so much demand for primary care, it is no surprise that many of our clients utilize Advanced Practice Providers (APPs) to close the gap. In fact, approximately three out of every four primary care physicians surveyed indicated using APPs within their practices. As shown in Figure 10, this was higher than any other practice type.

We believe organizations must take a more holistic approach to provider/physician workforce planning in 2021. Learn more in HSG’s landmark whitepaper on manpower planning.

7) Changes to the 2021 Medicare Physician Fee Schedule will create an opportunity for organizations to update provider compensation plans.

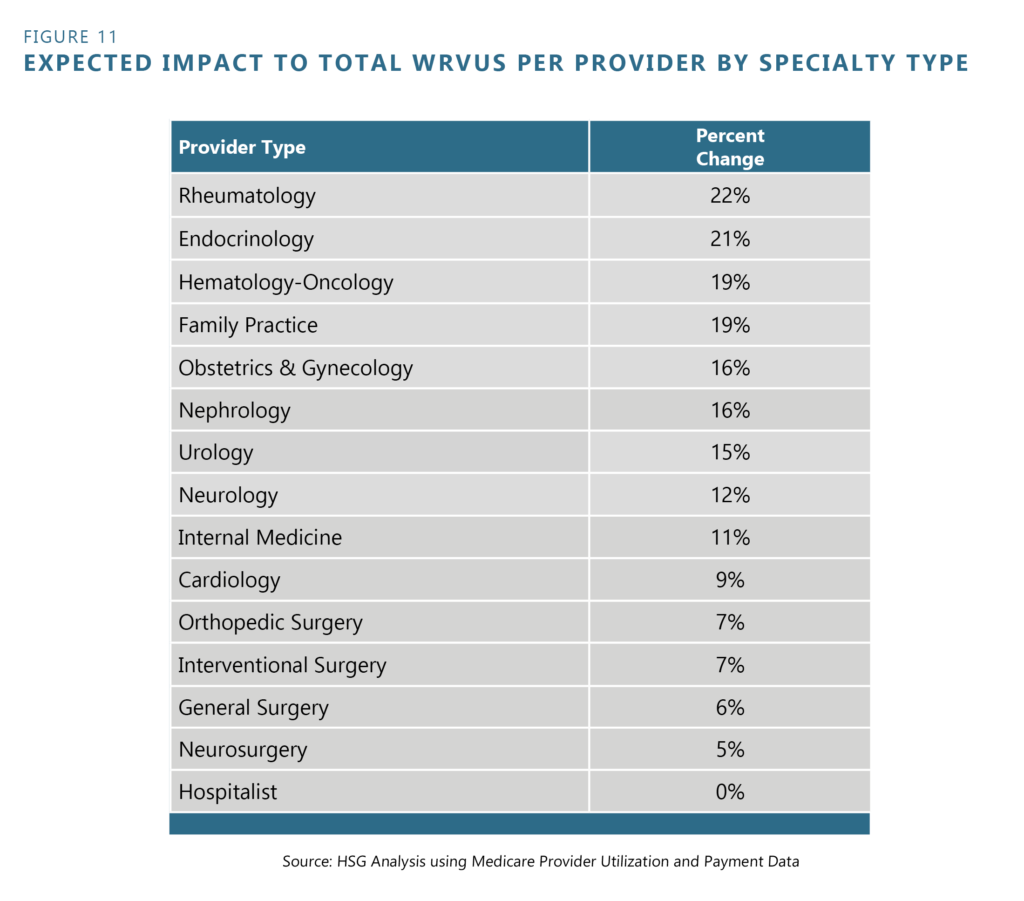

As CMS continues to make changes to the 2021 Medicare Physician Fee Schedule (MPFS), many employed providers will undoubtedly start to wonder what it means for their paychecks. After all, most physicians have wRVU-based incentives, and new weights for E&M codes may cause per-provider wRVUs to increase by as much as 20%. Details are shown in Figure 11.

There remains a great deal of uncertainty around the precise impact on organization finances and how provider compensation might need to shift accordingly. Specifically, CMS’ rapid-fire changes to the per RVU payment rate make it difficult for organizations to settle on revenue projections. Additionally, new E&M coding guidelines may result in a different distribution of E&M levels, which obfuscates efforts to predict a given provider’s wRVUs under the 2021 MPFS.

Many of our clients are addressing this uncertainty by utilizing 2020 wRVU values for compensation purposes. This change allows 2021 to serve as a transition year to update compensation plans to adjust for the 2021 MPFS and also ensure alignment with organizational goals and adherence to industry best practices. Click here to learn more about HSG’s MPFS Transition Program.