Overview

Successful physician strategy demands data, not anecdotes. HSG provides deep healthcare market knowledge, ongoing measurement, and actionable insights. We empower healthcare leaders with a comprehensive understanding of inpatient, outpatient, and ambulatory performance.

Areas of Support for Physician Strategy

HSG comprehensively supports health systems in all aspects of Health System Strategy, including:

Health System Enterprise Strategy

In today’s healthcare environment, setting organizational direction must balance the aspirations of the future with the realties and needs of the present. HSG’s process for Health System Strategy focuses on long-term financial viability through a focus on profitable growth, creating payer leverage, and provider growth and alignment.

Medical Staff Development Planning

Physician and Advanced Practitioner Recruitment Planning must be inexorably linked to the health system’s overall strategy, market growth strategies, and service line strategies. HSG works with health systems to link strategies to relevant market data to create the right workforce development plan.

Market and Service Line Growth Strategy

Profitable top-line growth comes from identifying and seizing opportunities within the market. HSG works with health systems to comprehensively identify and implement strategies at the market and service line level to achieve success.

Subservices

HSG leverages its proprietary set of market and provider network data analytics to help our clients understand the current state of the market, build effective strategic planning initiatives, monitor performance against defined objectives over time, and reassess and reprioritize on an ongoing basis.

Claims Data Analytics™

Create a comprehensive view of your opportunities and areas for improvement by leveraging HSG Advisor’s proprietary all-payer healthcare claims data analytics and advisory services to better understand competitive dynamics related to your markets, service lines, providers, and patients.

Outpatient Market Share

Gain a competitive advantage with insights into your health system’s market share. Evaluate your health system with customized reports providing overall market share, service line and sub service line market share, and geographic market share for professional and technical components of all relevant service lines.

State-Level Market Share

Create easy-to-understand visual overviews of state-level inpatient, outpatient, and emergency market share data, tailored to your specific market definitions.

Patient Flow

Gain a competitive advantage with insights into your health system’s market share. Evaluate your health system with customized reports providing overall market share, service line and sub service line market share, and geographic market share for professional and technical components of all relevant service lines.

Provider Dashboard

Evaluate your health system’s overall Physician and Advanced Practice Provider market share by specialty group, specialist, and subspecialist share by geographic region for professional services rendered by relative providers—a key metric in all reporting.

Competitor Dashboard

Develop stronger business intelligence reports, identify incremental opportunities, and turn information into action, faster in HSG Dashboard

Provider Needs Analysis

HSG’s Provider Needs Analysis process provides health systems with a customizable approach to evaluating provider supply and demand and succession planning challenges across their market.

Market Demographics

Create a demographic overview of each health system’s market definition at the zip code level. This data provides context to growth strategy decision-making by contrasting directional data points about a market’s population—summarized in HSG’s “Demographic Strength” factor.

Employed Provider Network Operational and Financial Performance

While a Health System’s Employed Provider Network is a source of tremendous strategic and financial value, investment into the Employed Provider Network’s practices must still be optimized in order for health systems to have a healthy bottom line.

Related Resources

-

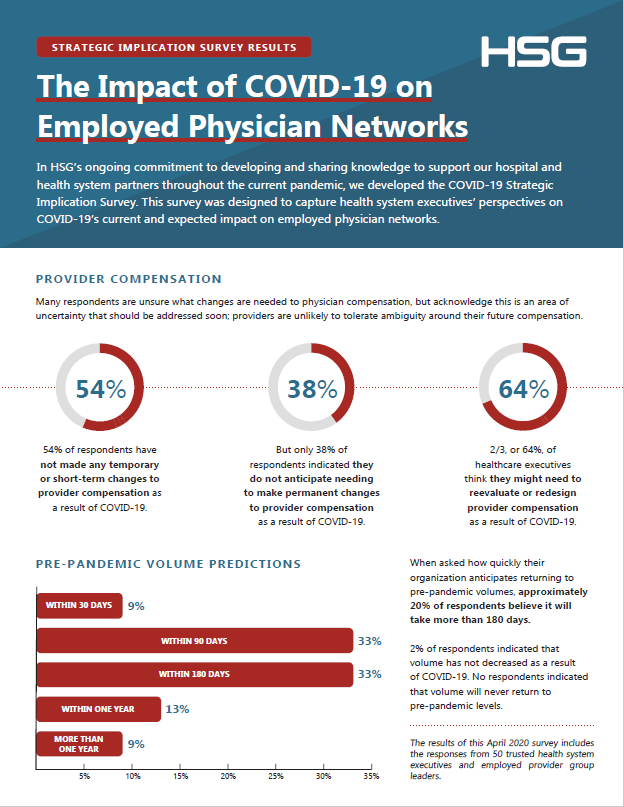

Becker’s Press Release – COVID-19 Strategic Implications Survey Results

HSG’s COVID-19 Strategic Implications Survey captures health system executives’ perspectives on COVID-19’s expected impact on employed physician networks.

-

The Pandemic & Strategy: Implications For Your Employed Physician Network (Webinar)

HSG addresses physician network strategy and challenges their clients have been facing the past two months as well as share our original research highlighting health sytsem executive core areas of concern as a result of the COVID-19 pandemic.

-

Emerging from COVID-19 Restrictions: Immediate Practice Implications (Webinar)

The recently released CDC/White House Opening Up America Again guidelines (April 16th) clearly indicate that medical practices will not be immediately returning to business as usual.