Improving Ambulatory Revenue Cycle Performance | Download a PDF Version of the Case Study |

OVERVIEW

A community health system in the Midwest was struggling with the financial performance of its 98 employed providers. As a result of the health system partnership with HSG, net revenue for the physician group has grown from a historic average of $6.7 million per month to $8.3 million per month, an average increase in net revenue of $4.8 million per quarter.

CLIENT QUICK FACTS

Based in Midwest Community 30 Minutes from Tertiary Competitors

25-bed critical access hospital

$98m net revenue

90+ employed providers

Client since: 2012

CHALLENGES

Health system executives came to HSG with significant revenue cycle and payor credentialing issues within the employed provider network. Collections for the group were declining and nearly 20 providers had not been credentialed by payors, preventing the group from billing for their services.

THE PROCESS

Key focus areas included: 1) Increasing clean claim rates by identifying billing rules with the electronic health record (EHR) vendor; 2) Training and educating the entire central billing office (CBO) staff on payer specific billing rules; and 3) Addressing the credentialing issues by completing, updating, or initiating over 200 payer enrollment applications. More specifically, HSG provided on-site support in two main areas:

THE RESULTS

Full time interim leadership of employed network revenue cycle operations for 14+ months.

Resources to credential new and existing providers with payers.

HSG led a comprehensive revenue cycle redesign. Our team evaluated performance, assessed processes that were broken and worked with leadership to implement the new processes all focused on improvement ambulatory revenue cycle performance.

As a result of onsite leadership and credentialing support, accomplishments include:

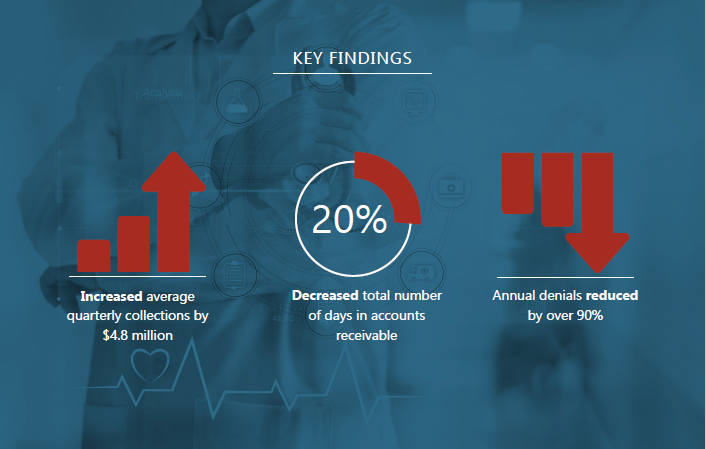

Annual denials reduced by over 90%.

Days in accounts receivable decreased by nearly 20%.

15+ providers credentialed (previously uncredentialed for over 12 months).

Average physician group quarterly collections increased by $4.8 million.

Additionally, our team retrained and redefined several roles in the CBO and redesigned the

workflows.

This included standardization of copay collection policies and scheduling approaches. Management reporting was also developed to hold employees accountable to these metrics.