Summary

Aultman Medical Group is a not-for-profit healthcare system that employs 140 providers across 19 specialties with locations that span six counties in Canton, Ohio. They had a strong desire for a comprehensive physician revenue cycle improvement process redesign after preliminarily evaluation of standard account receivable metrics.

Challenge

Aultman Medical Group sought to optimize its revenue cycle operations to help address internal structural factors impacting the organization financially. The leadership also was determined to standardize its processes and increase financial accountability and consistency of metrics across its clinics through an in-depth physician revenue cycle improvement process.

HSG’s Physician Revenue Cycle Improvement Approach

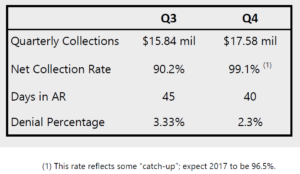

Aultman Medical Group engaged HSG to provide a comprehensive physician revenue cycle improvement and redesign process consisting of full-time management and support. The HSG team evaluated historical data and recommended consistently following revenue cycle indicators, implemented a daily budgeted volumes report, developed a dashboard, reorganized the CBO structure, resolved an insurance denials backlog issue, standardized a fee schedule, and developed a staffing tool. These and other steps led to 3% revenue cycle lift or a $2.5 million cash improvement and a 20% decrease in A/R.

Key focus areas of the project included increasing accountability and visibility of metrics across the revenue cycle; therefore, HSG initially provided full-time managerial support to streamline communication and transparency between the CBO and the different practices. The team collaborated to reestablish communication lines between the various points of contact.

HSG worked with the Aultman leadership to develop a list of key financial indicators that required monthly analysis, establish priority when analyzing these indicators, implement a revenue cycle meeting structure, and allow staff to work towards financial goals. To help Aultman identify revenue leakage and improve their annual net revenue, HSG streamlined insurance denials by organizing the CBO around the revenue cycle process: Insurance Verification, Coding and Charge Posting, Claims Processing and Payment Posting, Insurance Follow-up and Self-Pay Collections which also included Refunds. In addition to the backlog of denials, there was an issue in the management structure of the coding department. HSG addressed the lack of proper management due to certification by advising all coding and charge entry staff to change their work location to the CBO and start reporting to the Coding and Charge Entry Lead.

The final elements to the project involved process documentation, fee standardization, and staffing and productivity benchmarks.

Physician Revenue Cycle Improvement Process Results and Impact

The results below show performance in Q3 vs. Q4 of 2016. All major indicators show improvement. The results were produced with an addition of 8 FTEs and a reassignment of 14 individuals within the network.

Download a PDF of the Case Study Here to Share with Your Team