Case Study | Download a PDF Version of the Case Study |

OVERVIEW

A Southeastern multi-hospital independent system located 45 minutes from a large tertiary market had historically struggled to attract patients from local competitor markets. Simultaneously, the system was also losing patients from its home market to tertiary health systems, specifically for high-complexity services.

CLIENT QUICK FACTS

- 188-bed acute care hospital

- 50+ employed providers

- $330M net revenue

- Client since: 2019

HSG started working with this system to address these issues, beginning with an investment in building strategic outreach. Growth team members were directed to focus on building relationships with key primary care and specialty care providers in an eight-county region.

– D.J. SULLIVAN, HSG DIRECTOR

This hospital has a central initiative focused on attracting new patients for key service lines while maximizing patient retention within the employed network and closely aligned primary care providers. The hospital had a blind spot regarding specific patient leakage volumes and no systematic way of prioritizing provider liaison initiatives. Utilizing HSG Patient Flow,™ which measures provider volumes and relationship patterns in 90-day timeframes (optimal for patient access), the organization was then able to focus on two key areas:

THE PROCESS

CHALLENGES

THE RESULTS

1. Identify top referring providers on a quarterly basis.

Prioritizing the practices according to the data will inform opportunities to optimize patient retention from local primary care providers.

2. Measure patient leakage amongst area practices on a quarterly and annual basis.

Prioritizing the practices according to the data will inform opportunities to optimize patient retention from local primary care providers.

The strategy and business development teams utilized key data insights to optimally prioritize their time (by review of practice and provider data volumes), resulting in the fastest return on their investment in strategic growth initiatives. In a 12–18-month timeframe, the health system was able to grow its total contribution margin by over $10M. Its strategic growth investment in data and personnel were identified as the major contributor to the system’s success.

1. Example 1

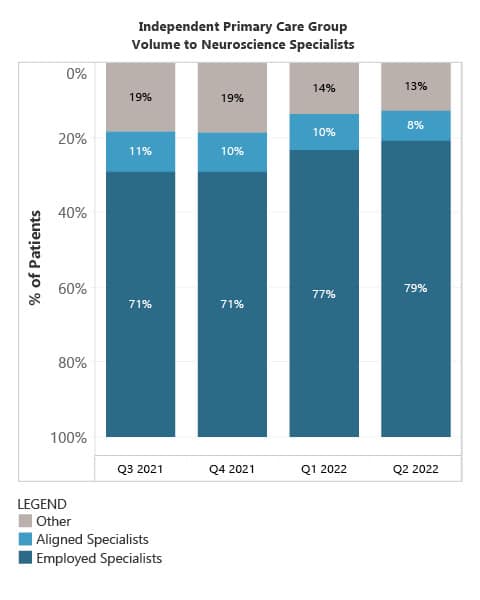

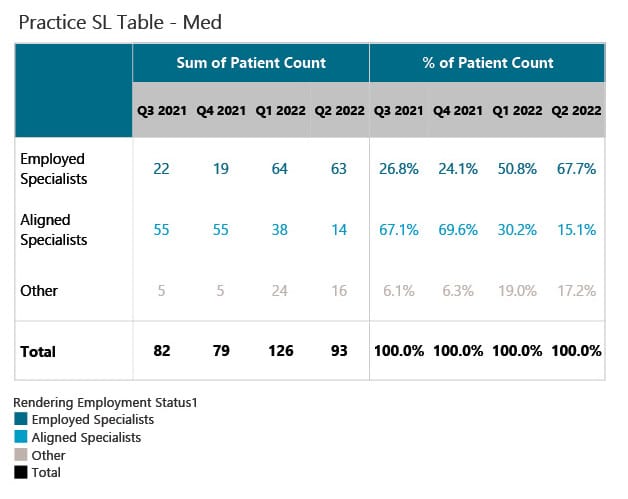

The health system was focused on building new neuroscience capabilities to serve its population. They were able to increase patients from a singular independent primary care group to its employed neuroscience specialists by more than 200 unique patients, increasing patient keepage from that one practice by 8% over the 12 months.

KEY FINDINGS

Some of the most significant impacts on the organizational contribution margin came from transitioning patient volumes from specialists on the medical staff (but not performing procedures at the hospital locations) to employed specialists.

Example 2

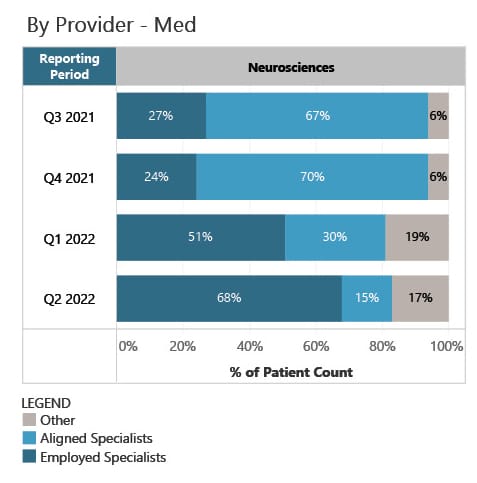

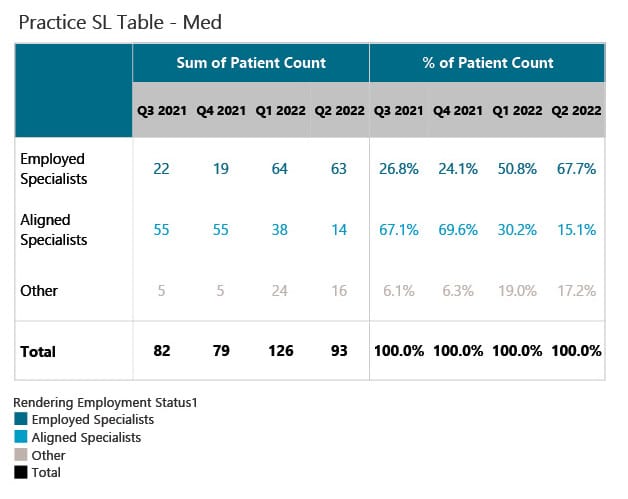

The example below shows patients from an individual primary care provider who transitioned to neuroscience specialists (medical staff aligned vs. employed) in a 90-day timeframe. The patient keepage to employed neuroscience specialists from 27% to 68% over a 12-month timeframe. While the patient volumes are not as significant at the individual primary care provider level, minor changes such as these extrapolated over an entire market resulted in substantial financial returns for this health system.

These examples of increased patient attraction and leakage prevention by practice and provider were consistent across primary care practices throughout the entire 8-county region and across numerous prioritized specialties (cardiology, general surgery [bariatrics], urology). All these efforts working in tandem lead to the $10M+ increase in contribution margin for the health system.

To learn more about HSG’s proprietary approach to patient attraction and retention measurement and implementation of strategic plans to support growth, or to request a complementary HSG Patient Flow™ report, contact DJ Sullivan directly at djsullivan@hsgadvisors.com