|

Download a PDF copy to share with your team |

INTRODUCTION

The United States has been experiencing and continues to experience a shift in physician practice ownership.

According to the American Medical Association (AMA), 2018 marked a point time at which for the first time, more doctors are employed than are owners in private practice. In a press release, the AMA described the event as “the continuation of a long-term trend that has slowly shifted the distribution of physicians away from ownership of private practices.” AMA’s release indicates that in 2018 employed physicians (physician and hospital-owned practices) were 47.4% of all physicians. Self-employed (owner) doctors only represented 45.9% of all practicing physicians. The remaining 6.7% were independent contractors. According to the AMA’s 2018 Policy Research Perspectives in 2012, 60.1% of physicians worked in physician owned practices (“private practice”). By 2018, that number had decreased to 54.0%, with over half of that decrease according in the two years from 2012 to 2014. According to the AMA’s 2018 survey, “34.7% of physicians worked either directly for a hospital or in a practice at least partly owned by a hospital in 2018 – up from 29% in 2012.”

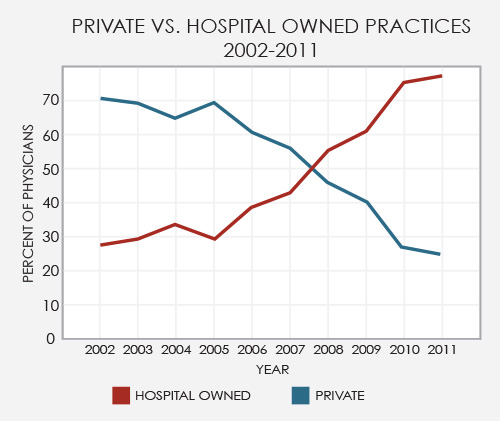

The Medical Group Management Association (MGMA) is a national medical practice membership organization with 50 state affiliates that represents more than 40,000 medical practice administrators and executives in practices of all sizes, types, structures and specialties. MGMA also publishes a variety of industry reports based on surveys of its membership and other eligible participants. Based on MGMA’s survey data, the shift to hospital employment of physicians has been more pronounced. According MGMA, by 2011, more than 70% of practices were owned by hospitals and health systems (as shown in the graph below, which is based on MGMA survey data).

Regardless of the data source, one thing is sure: since the early 2000s, hospital and health systems have gone through an accelerated growth phase as transactions with physicians and physician-owned practices have reached an all-time high. This trend will undoubtedly continue as hospitals seek tighter alignment with physicians while population health initiatives, quality/outcome improvement programs, and value-based reimbursements mechanisms continue to evolve. Additionally, hospital-owned practices have no choice but to grow as older physicians who own their practice retire, and younger physicians, who have no interest in being practice owners, seek employment opportunities.

Alignment goes beyond employment and manifests in the form of Professional Services Agreements, Co-Management Agreements, Bundled Payment Programs, Joint Ventures, Medical Directorships, Call Coverage Agreements, and other arrangements. During this stretch of unprecedented changes, many best practices have emerged for making these transactions. Setting clear expectations for the process is essential.

Here are three principles to follow when guiding your organization through transactions:

|

1 |

KNOW WHAT YOU ARE BUYING |

Know what you are getting into from a performance perspective and how to operationalize it. Complete a detailed assessment of the practice operations and its performance before executing a contract and finalizing a transaction. Not every practice is a good fit, culturally or financially. Don’t be so eager to “make a deal” that you lose the long-term goal of being financially and culturally sustainable for the community you serve. Walk away from a potential deal if it is not a good long-term fit. Take a step back and try and evaluate the deal at all angles with an unbiased perspective. Trust your instincts. Don’t be overly confident that you can fix a bad fit. This is like marrying someone thinking you can fix their annoying habits and flaws.

|

2 |

EVERY DEAL IS DIFFERENT |

If you have seen one physician deal, you only have seen one physician deal. They are never the same. Each deal is unique because each involves people with different personalities, goals, and personal aspirations, and different organizations with different cultures, strategies, and organizational objectives. A cookie-cutter approach does not work in terms of compensation and financial structure or fair market value assessment and determination. While hospitals and health systems should have standards and parameters around compensation structure, you need to have an appropriate amount of creativity and flexibility at your disposal. Leverage a flexible system to tailor the structure such that the right incentives are available. Parameters and standards are a must, but they shouldn’t get in the way.

From a structural perspective, many factors influence the compensation arrangement. If the physicians are adamantly against employment and want to maintain a certain level of independence or to maintain identity or flexibility to provide services in other areas or markets, consider implementing a Professional Services Agreement. If bringing multiple groups together to positively affect inpatient service line outcomes, efficiency, quality, and patient satisfaction is the purpose, then Co-Management may be the appropriate structure.

For a soon-to-be employed physician practice that will lead primary care outreach efforts, a pure eat-what-you-kill Work Relative Value (“wRVU”) focused model is not likely to achieve the results you desire. The physicians are not going to be motivated to leave locations of known volume for locations where volume is unknown if the compensation is not appropriately structured. Likewise, a significant emphasis on quality-based financial incentives is not going to achieve desired results when driving patient volume is the true intent. Conversely, your not likely to get the quality and customer satisfaction you want when volume and production are King

Fair market value assessment and determination requires creativity, and the initial step involved with the creative process involves combining or blending multiple sources for internal fair market value evaluations. According to Phase III of the Stark Law, “Reference to multiple, objective, independently published salary surveys remains a prudent practice for evaluating fair market value.” Not only is evaluating multiple sources the most prudent approach from a business perspective, but it is also the most compliant.

While evaluating multiple surveys is clearly necessary, it might also be appropriate to evaluate various data sets within those surveys (i.e., by geographic region, rural versus urban, or hospital-owned versus physician-owned). Additionally, for arrangements such as Professional Services Agreements with independent groups, benchmarking and fair market value analysis may require incorporation of comparable data for benefits and malpractice costs. In other cases, perhaps other operational and overhead costs need to be considered and incorporated, such as billing and collections resources, or technology costs for telemedicine services/coverage.

Finally, new, nontraditional, and/or multifaceted services such as telemedicine coverage and neurohospitalist or surgicalist services may require additional creativity and the utilization of a variety of sources and data sets. Data sets such as clinical hourly rates, medical director compensation data, call coverage rates (unrestricted or restricted), and per procedure rates may apply. An experienced evaluator knows the nuances and limits of each type of data and how best to utilize the data sets and sources to document fair market value.

|

3 |

BE FLEXIBLE AND WILLING TO COMPROMISE |

As previously stated, sometimes you need to walk away from a deal. Certain points are deal-breakers, upon which negotiation is not possible, and sometimes, not permissible. Have a clear understanding and agreement on which points are non-negotiable. Closing a deal will require compromise, and very rarely does the end deal look exactly like the proposed deal when discussions started.

For more information, please contact Neal Barker.