|

Download a PDF Version of the Article |

Misusing Provider Compensation Survey Data in 2021 and Beyond: A Cautionary Tale About Creating Financial Unsustainability

This article outlines an example of how misusing provider compensation survey data can result in a primary care physician increasing his/her total earnings by 44% despite a constant patient volume.

Historically, provider compensation and productivity surveys have been key components in determining fair market value (FMV) for provider compensation and per work relative value unit (wRVU) compensation rates. Surveys from the Medical Group Management Association (MGMA), the American Medical Group Association (AMGA), and other organizations provide market benchmarks useful for constructing provider offers, designing compensation plans, and determining FMV.

However, a confluence of issues will create problems as organizations use and interpret these survey data in the immediate future.

We’ve previously written about these issues in more depth but specifically note that:

- Reduced volume during the COVID-19 pandemic will lead to artificially high per wRVU compensation rates in surveys based on 2020 data.

- For many specialties, changes to the 2021 Medical Physician Fee Schedule (MPFS) will result in wRVU production that is significantly higher than levels reported in surveys using data from prior years.

To showcase the issues that can arise from using the most recent survey data, let’s consider an example.

In this hypothetical example, an organization utilizes wRVU-based productivity models to determine physician compensation. Every three years, the organization utilizes current MGMA survey data to update the compensation rates per wRVU. While this example features a fictitious organization and physician, it is important to note that many of our clients have compensation philosophies that closely align with this hypothetical scenario.

Baseline: Rates Determined in 2018

First let’s look at data from 2018, the time of the organization’s last rate update. Figure 1 shows family medicine data from the MGMA 2018 Provider Compensation and Productivity Survey based on 2017 data.

Figure 1: Median Values According to 2018 MGMA Survey

| Metric | Count | Median |

|---|---|---|

| Total Compensation | 7,118 | $236,935 |

| wRVUs | 6,111 | 4,804 |

| Total Compensation per wRVU | 6,084 | $50.29 |

Based on these data points, the organization selected a rate of $50 per wRVU to be utilized for all primary care physician compensation models. Thus, a family medicine physician producing 5,000 wRVUs (4% above the median) would earn $250,000 in compensation (6% above the median).

Three Years Later: 2021 Update

Now, three years later, the organization is planning to update rates utilizing the most recent survey data. Figure 2 shows family medicine data from the MGMA 2021 Provider Compensation and Productivity Survey based on 2020 data.

Figure 2: Median Values According to 2021 MGMA Survey

| Metric | Count | Median |

|---|---|---|

| Total Compensation | 9,647 | $264,698 |

| wRVUs | 7,205 | 4,388 |

| Total Compensation per wRVU | 7,142 | $59.69 |

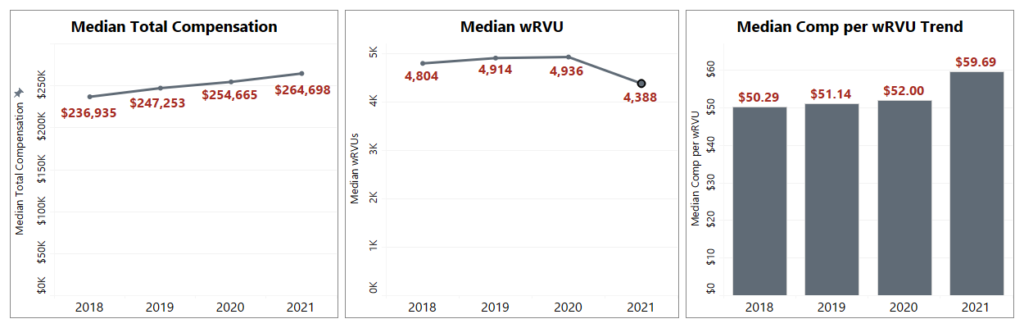

When comparing to the 2018 survey data, we see a large increase in the Median Total Compensation per wRVU. One important question is whether this increase is due to a fundamental shift in primary care rates or an artifact of temporarily depressed wRVUs during 2020. Observing the multi-year trends shown in Figure 3, we see that compensation has seen minor increases each year. wRVUs, on the other hand, remained relatively constant until decreasing substantially in the 2021 survey (which is based on 2020 data). This caused a substantial yet artificial increase to the Median Compensation per wRVU value for 2021. We therefore believe the most recently published survey data do not properly reflect market rates.

Figure 3: Multi-Year Trend in Median Compensation and wRVUs

Nevertheless, our hypothetical organization still desires to adhere to its existing policy of utilizing survey data to determine rates. Based on this philosophy and the data shown in Figure 2, the organization selects a rate of $60 per wRVU, 20% higher than the prior rate of $50 per wRVU.

Now, let’s consider the same physician we mentioned who produced 5,000 wRVUs during 2018 and apply the following assumptions:

- The physician’s patient volume remained relatively constant during 2018 and 2019. While volume was slightly reduced during 2020 due to COVID, the physician’s volume has rebounded and is expected to return to levels consistent with 2018 and 2019.

- Due to increased wRVUs values for office visits introduced by the 2021 Medicare Physician Fee Schedule, the physician is able to generate 20% more wRVUs for the same patient volume. (Click here to learn more about the 2021 MPFS)

- This results in the physician producing 6,000 wRVUs going forward.

Based on the preceding assumptions, the physician will earn $360,000 in compensation calculated by multiplying 6,000 wRVUs by $60 per wRVU. This is 44% more than the compensation earned during 2018 and 2019, despite seeing the same volume of patients. With continued reductions to the Medicare conversion factor, the organization is expecting revenue to remain flat. Without incremental revenue to support increased compensation, the organization has put itself on a path to financial instability.

Contact HSG to learn more or discuss how organizations are addressing these issues to protect financial sustainability.