In HSG’s extensive experience with brokering deals between hospitals and physicians, we’ve identified four key moves that are critical for success.

1: Communicate Expectations and Desires

Early in employment discussions, hospital leadership and the physician should discuss their motives and desired outcomes. This provides both parties with the opportunity to evaluate whether future discussions are needed and what points of interest are most important to each.

Each party must have a clear understanding of expectations or goals and how they will collaborate to achieve these objectives. Examples include quality measures, productivity goals, timely completion of medical records, timely reporting of charges, and participation in hospital or employer committees.

Before the formal employment offer is made, we encourage clients to provide term sheets that outline the basic components of the employment agreement. In one instance, the hospital was informed that the physician candidate was subject to a medical malpractice deductible. The hospital included terms in the term sheet that required the physician to provide a letter of credit to cover the deductible. The term sheet was provided four months prior to an expected effective date, giving the physician time to secure a line of credit and decide whether employment was still desired.

2: Perform Practice Due Diligence

Due diligence ensures the practice has no major operational or quality issues that could become a liability for the hospital. Depending on the practice’s size and complexity, due diligence takes 6-12 weeks. During this time, we review and analyze practice financials, historical compensation and production, payer mix, staffing, practice management and EMR systems, revenue cycle, and CPT data. This data enables the hospital to make a fully informed decision on whether to continue employment discussions.

During a recent due diligence project, we identified a cardiologist who was performing a higher-than-average rate of diagnostic procedures. When the procedures were normalized, the practice’s losses exceeded the MGMA median for cardiology practices. The hospital is now deciding whether the practice will be a liability or asset to their employed group portfolio.

3. Engage Currently-Employed Physicians

Performance isn’t the only factor to consider during due diligence. It’s also wise to determine whether the physician is a cultural fit with the employed physician network. Having currently-employed physicians meet their potential future partner is a good way to gauge compatibility and gives the candidate the opportunity to speak candidly with peers and gain a deeper understanding of what it means to be a part of your network.

4. Use a Production-Based Compensation Model with Quality Incentive

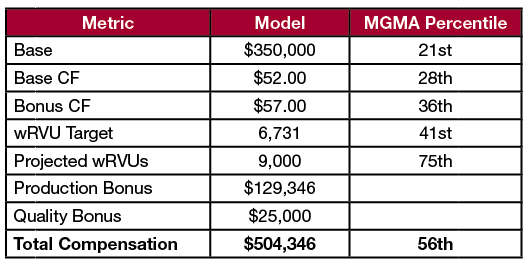

As reimbursement transitions from volume to value, physician contracts must follow suit. For physicians relocating to the market, we recommend a fixed or guaranteed base salary for two to three years, depending upon specialty and market, and a compensation model composed of a base salary, production bonus, and quality incentive. An ideal compensation model for a cardiologist is shown below.

Note that production outpaces total compensation by 19 percentiles to accommodate the benefit package. While such a large gap isn’t always possible, we rarely recommend compensating physicians in a way that causes compensation to outpace production. Not only does this become a fair market value liability, it adds to potential practice losses. Structuring the compensation model so it’s beneficial for the physician and doesn’t unnecessarily add to practice losses is a win for both parties.