Culture and Mgmt. Infrastructure

Culture and Mgmt. Infrastructure |

Download The Article to Share With Your Team Here |

The Critical Importance of Physician Culture and Management Infrastructure

When healthcare organizations struggle with their physician networks’ success, they often call HSG to help them understand the issues. Our network assessment projects involve analyzing data, visiting practices, and speaking to key stakeholders. However, to hone in and identify opportunities for improvement and guide overall network strategy, we must understand each provider’s perspective.

Given HSG’s depth of experience evaluating the provider perspective, we are frequently asked: “What are the elements that shape the way providers perceive our network?” The answer boils down to two key areas: group culture and management resources. If providers feel optimistic about these areas, they are more likely to have positive perceptions of all network areas. This information creates a strong case for employed provider networks to do two things.

1) Leverage existing or create a provider leadership council to establish a shared vision for the network in concert with the executive team.

- This unified plan, designed with all shareholders at the table, establishes a common vision for the network’s future. It is a cornerstone for building a strong culture. The shared vision should serve as a roadmap for successfully meeting collective goals and defining how the group should act and operate.

2) Ensure there is sufficient management infrastructure in place to support practice operations and drive organizational strategy.

- The overall network organizational structure may need to be realigned to match expectations. This includes selecting experienced personnel for each position.

The importance of group culture and management resources is backed by evidence from our client experience and opinion-based data collected from employed provider networks’ stakeholders who participated in HSG’s Network Evaluation Survey. The survey contains a total of 24 questions that fit into eight key categories:

- Aligned Compensation

- Culture

- Financial Sustainability

- Management Infrastructure

- Physician Leadership

- Practice Operations

- Quality

- Strategy

The survey questions utilize a five-point Likert scale to determine respondent agreement with a series of statements about the employed physician groups’ performance. This scale is quantified to calculate an overall score reflecting an individual’s positivity or negativity about group performance. Scores can be analyzed in totality, at the question level, or rolled up into key categories. For example, an individual who agrees with most statements on the survey will have a relatively high total score and a generally positive perception of the network.

In addition to providing valuable insights, these survey results can be aggregated to identify trends, commonalities, and relationships within the data. Our team can then apply these findings to our overall thought leaderships and frameworks, creating a virtuous cycle of learning.

When analyzing more than 600 recent provider responses, HSG identified two questions that correlate very strongly to overall network perceptions:

1) Our employed physician group has a definable, cohesive culture that is pervasive throughout the group and guides management, provider, and staff behavior.

2) Our network management team has the depth, resources, and capabilities it needs to successfully operate the network.

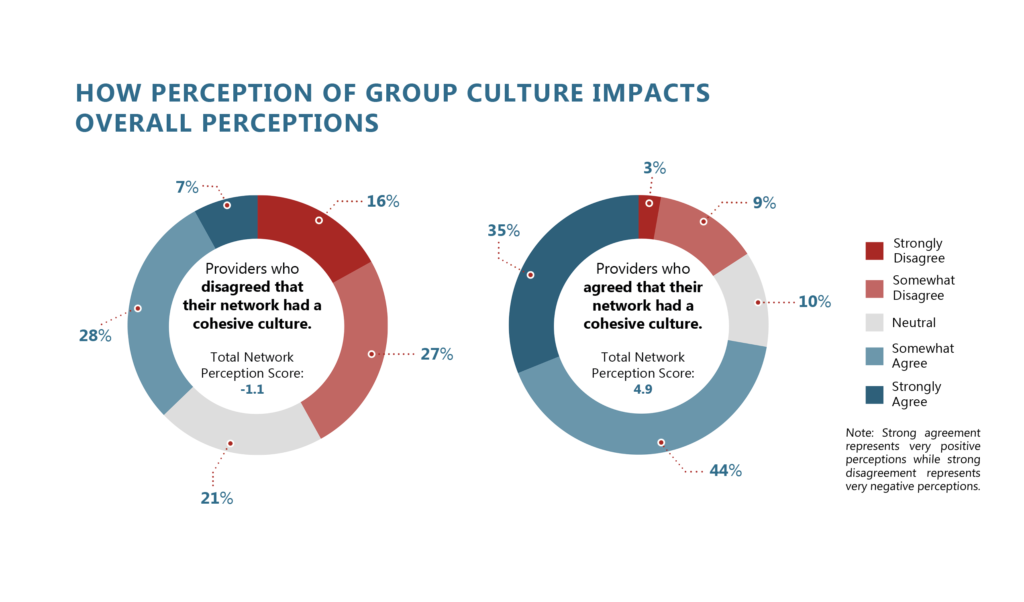

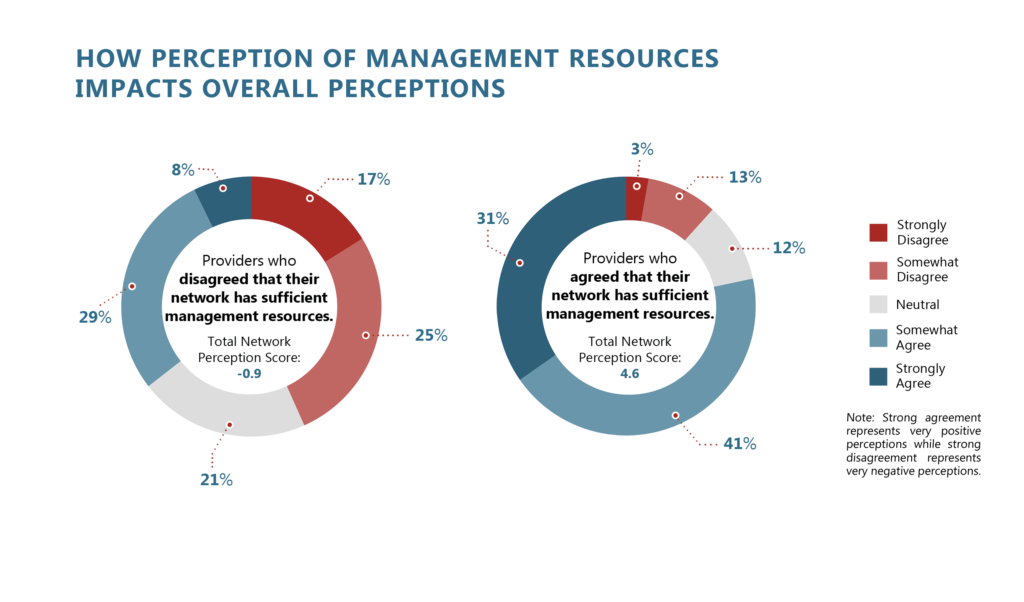

Individuals agreeing to these two statements were most likely to agree to similar statements throughout the survey. Overall, their perceptions of the group’s performance were more positive. Figures 1 and 2 below provide additional detail.

Percentages represent each cohort’s overall answer distribution for all other questions.

KEY TAKEAWAY: Providers who perceive their group as having a cohesive culture strongly agree with 35% of all other questions. Providers who don’t perceive a cohesive culture are far less positive; this group strongly agrees with a mere 7% of all other questions.

Percentages represent each cohort’s overall answer distribution for all other questions.

KEY TAKEAWAY: Providers who perceive their group as having sufficient management resources strongly agree with 31% of all other questions. Providers who don’t perceive management resources are sufficient are far less positive; this group strongly disagrees with 17% of all other questions.

Note: The Total Network Perception Score represents the aggregate average level of positivity for all questions. The scale ranges from -10.0 (strongly disagreeing with every question) to +10.0 (strongly agreeing with every question)

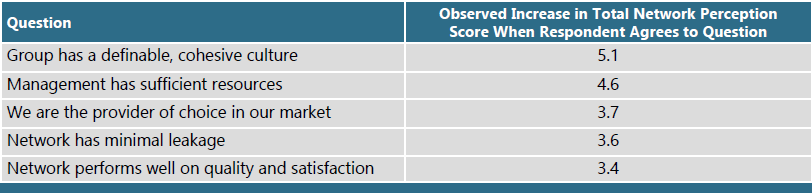

While we acknowledge a degree of cross-correlation with all questions, the above questions are the strongest individual indicators of overall perceptions. The following table shows additional questions having a weaker correlation to increases in the Total Network Perception Score.

The results are clear: A group’s providers will have more positive perceptions if there is sufficient management infrastructure and cohesive group culture.

Although these data do not distinguish between causation and correlation, HSG’s hands-on work with employed medical groups across the country leads us to believe that culture and infrastructure are key drivers of network performance – not the other way around. It is tempting to assume cohesive culture comes as a result of improvements in other areas, particularly with culture. Our experience is the opposite: concerted effort to build culture is often a precursor to operational and strategic breakthroughs.

Contact our experts at HSG to learn more about the importance of culture and management infrastructure in provider perceptions of employed group performance.