2021 MPFS Proposed Rule

2021 MPFS Proposed Rule |

Download a PDF Version of the Article to Share With Your Team |

2021 Medicare Physician Fee Schedule Overview

On August 4, the Centers for Medicare & Medicaid Services (CMS) released its calendar year 2021 Medicare Physician Fee Schedule (MPFS) Proposed Rule. In the proposal, which assuming all changes become final, would take effect on January 1, 2021. The final MPFS is typically published on November 1st, but due to COVID-19, that important event has been pushed back 30 days to December 1st. The deadline for formal comments, which will most certainly come in abundance, is October 5th.

2021 MPFS – Potential Impact on Physician Compensation

Proposed Changes Response Planning

Between now and then, hospitals and health systems with employed provider networks, need to start planning for the potential impact of these proposed changes. CMS’s proposed MPFS changes covered everything from changes to Work Relative Value Unit (wRVU) values for certain CPT codes to changes in scope of practice policies for Advanced Practice Providers (APPs) to changes related to CMS’s quality payment program.

Here is a brief summary of the proposed changes that HSG feels will have the most immediate and significant impact on employed provider networks, specifically the impact on Medicare’s payment for professional services and networks’ compensation of providers:

- The 2021 MPFS conversion factor will be decreased $3.83 (-10.6%) to $32.26 from 2020’s MPFS conversion factor of $36.09. This means that services that do not have any change in Relative Value Unit (RVU) values will see a decrease in payment from Medicare of 10.6%. The decreased reimbursement will not be fully offset by any reimbursement increases realized through the MIPS or APM paths of the Quality Payment Program. MIPS path maximum increases estimated to be < 2% and APM path is 5%.

- Various changes related to outpatient/office evaluation and management (E&M) services and codes, including:

- removing 99201;

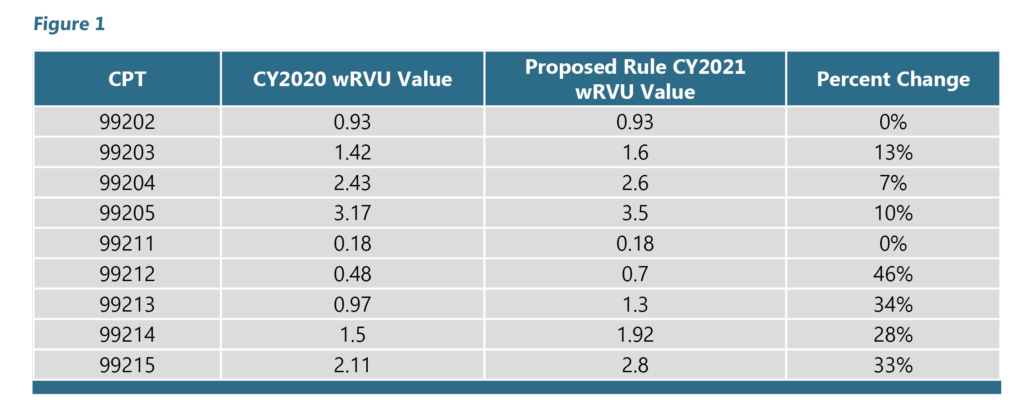

- increasing wRVU values for E&M codes 99202 – 99205 and 99211 – 99215 (Figure 1 below shows the proposed changes to wRVU rates for E&M Codes);

- redefining E&M code selection criteria to be driven by medical decision making (MDM) or time spent versus history and/or exam elements;

- adding two new add-on codes for 99205 and 99215—one code for extended time (99XXX) and one code for patient complexity (GPC1X); and

- setting new assumed time ranges for E&M codes.

- Permanent and temporary additions to telehealth codes.

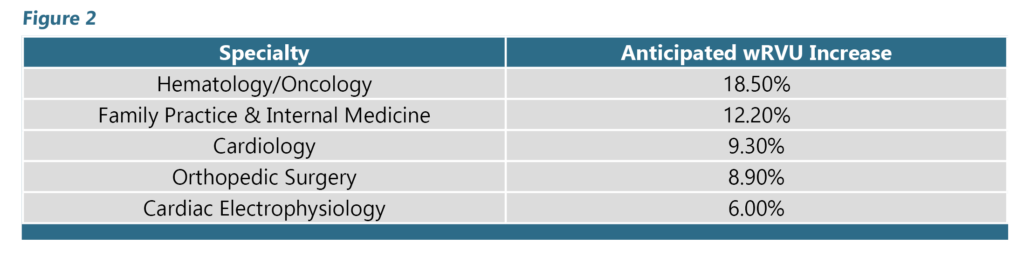

Because coding distribution varies among providers and specialties, we do not expect a uniform impact across specialties. Primary care providers, for example are likely to generate a higher proportion of wRVUs from office visits compared to proceduralists. We would therefore expect primary care providers to be more heavily impacted by the potential changes to E&M codes. This can be seen in Figure 2, which estimates the wRVU impact for selected specialties based on actual practice patterns observed in a national Medicare database consisting of more than 240 million visits by approximately 970,000 providers.

Assuming these changes become final on December 1st, many industry organizations, consultancies, and provider advocacy groups are projecting significant increases in provider compensation if the providers’ E&M profile remains unchanged. Historic E&M performance is less likely to change if the provider chooses codes based on Medical Decision-Making criteria. However, time spent for most E&M codes increased. A provider who historically spent 30 minutes total time with a new patient may see a two-level E&M code decrease with the new parameters. And because the changes have to be budget neutral by law, no increase in professional service reimbursement.

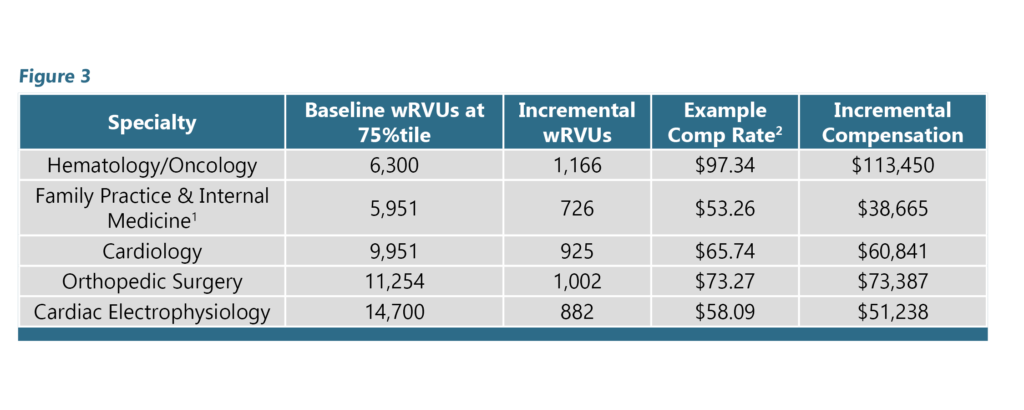

This significant increase in compensation is due to the broad, industry-wide utilization of wRVU-based compensation models for employed physicians and APPs. Obviously, given the fact that the changes in wRVU values are happening with E&M codes, those specialties that rely heavily on E&M codes for the majority of their total wRVUs are going to be impacted the most. Figure 3 shows the potential compensation increase for physicians producing wRVUs equal to the MGMA 75th percentile. Incremental wRVUs are calculated by multiplying the Baseline- 75th percentile wRVU values by the Anticipated wRVU Impact from Figure 2. Incremental wRVUs are then multiplied by the Example Compensation Rate to determine the Incremental Compensation generated by the proposed changes.

While this analysis highlights the potential magnitude of compensation impact by physician type, it should be noted that actual impact will vary depending on a variety of factors. A few considerations:

- This analysis assumes baseline volume and coding distribution will remain constant. If fee schedule changes lead to changes in practice or coding patterns, compensation will be further impacted.

- This analysis assumes all incremental wRVUs generate additional compensation for the physician. Depending on the compensation model, the actual amount of incremental compensation will be impacted by a physician’s current productivity level in relation to the productivity incentive wRVU threshold.

- Multi-tiered compensation plans will further influence the potential compensation impact.

If your hospital/health system’s employed provider network includes any, all, or some of these, you need to start planning today. HSG has already begun assisting clients around the country with a two-pronged approach consisting of a planning and modeling phase and a provider education phase.

Planning and Modeling Phase

- The first step in the planning and modeling phase is gaining an understanding of the potential impact on wRVU production, hence wRVU-based compensation due to the proposed changes. This is dependent on your network’s mix of specialties and providers, as well as the providers’ individual coding patterns and level of productivity…not to mention contractual wRVU thresholds (or targets) and bonus rates per wRVU. Armed with details and specifics in these critical areas, HSG and the client work together to model, specialty-by-specialty and provider-by-provider, changes to wRVU targets and bonus conversion factors that yield productive compensation that is financially sustainable and feasible, not to mention fair market value and commercially reasonable.

- Next, achieving an understanding of the potential impact on top line professional revenue based on CPT volume and payer mix is critical to visualizing a full picture of the potential impact of the proposed MPFS changes.

Provider Education Phase

- Finally, the first of three provider education sessions in the provider education phase focuses on education around CMS’s new CPT codes (telehealth, virtual visits, add-on codes, etc.) and documentation requirements that are most likely to remain in CMS’s final plan for 2021. The second session, after CMS’s changes are final, highlights those changes for 2021 and focuses on educating providers on new E&M code documentation requirements and MDM criteria. The final session revisits these areas after the providers have had experience with the changes in everyday practice.

HSG is here to help you and your employed provider network team start planning and educating for CMS’s proposed changes to the 2021 MPFS. Don’t delay, January 1st is just around the corner.

Related 2021 MPFS Schedule Content

You can learn more by viewing or downloading the slides from a pre-recorded webinar by HSG’s Dr. Terry McWilliams outlining all of the core content health systems should know related to the 2021 Medicare Physician Fee Schedule Proposed Final Rule.

Dr. McWilliams walks through background on the Medicare Physician Fee Schedule, a summary of proposed changes for 2021, and in-depth review of significant changes and their potential impact on your employed physician network.