Many hospitals are increasingly challenged by the financial performance of their employed physician networks.

As these networks grow, the concern about financial performance moves to the forefront, with the losses becoming an increasingly visible drag on the system’s overall profitability. This, in turn, puts pressure on health system and physician network leadership to, at a minimum, figure out how to bend the cost curve, if not reduce net losses altogether.

From our vantage point, the overall key to building high-performing employed physician networks is financial sustainability. This is the point at which health system leadership is reasonably assured the performance of the employed physician network is not a detriment to the health system’s overall financial performance, and that in the long term, the physician network has the infrastructure, management capabilities, and provider engagement to make maintaining the cost curve realistic.

When assessing the performance of employed provider networks, we find a litany of issues contributing to poor financial performance that must be identified, explored, and addressed through an implementation plan. While not all of these are present in every network, most networks are experiencing at least a handful of these issues:

| 1 |

Underperforming revenue cycle This includes underperformance in hitting benchmarks in the billing office (in the hospital financial office or in a dedicated central billing office); properly credentialing providers with payers in a timely manner; maximizing revenue capture in the office setting; documentation and coding. |

| 2 |

Misalignment of compensation and performance This includes providers being overpaid relative to production; providers being given incentives inconsistent with network financial goals; or providers having incentives focused on individual (not group) performance. |

| 3 |

Inconsistent and/or inefficient approaches to operations, staffing, and space usage Most commonly, this relates to practices being left to operate much as they did before they were employed – which results in wild variation on a practice-by-practice basis when it comes to throughput, staffing, space, and other operational indicators. |

| 4 |

Insufficient usage of advanced practitioners. This applies to the mix of Physicians to Advanced Practitioners (AP’s), as well as whether AP’s are being used at top-of-license or as glorified clinical staff. This results in cost per provider being excessive relative to production. |

| 5 |

Underinvestment in management infrastructure Networks struggling with financial performance frequently under invest in their management team, resulting in a crippling lack of resources that create an inability for management to move beyond “fighting fires” on a daily basis. |

| 6 |

Poorly designed organizational structure that creates a lack of accountability Many employed physician networks are still managed by multiple hospital executives, or have executive directors/managers who are not held directly accountable for performance of the network. If there’s not a place where the buck stops, the performance will not improve. |

| 7 |

Strategic issues disguised as performance issues In some cases, poor financial performance is a symptom of larger strategic issues at the network or health system level. As an example, if the employed network doesn’t have the right primary care strategy and a sufficient primary care base, all the performance improvement initiatives in the world won’t make employed specialty practices productive and profitable. |

| 8 |

Employing “who we have” vs. “who we need” Not every provider and practice who was brought into the network years ago is still a strategic fit for the network. Some providers are never going to have the mindset that will make them an effective employed provider. Some practices brought into the network long ago under a different strategic mindset may not be relevant now. |

To identify these (or other) issues in networks looking to create financial sustainability, a phased assessment in three parts is recommended. The first phase includes opportunity identification, followed by opportunity exploration and then, finally, implementation.

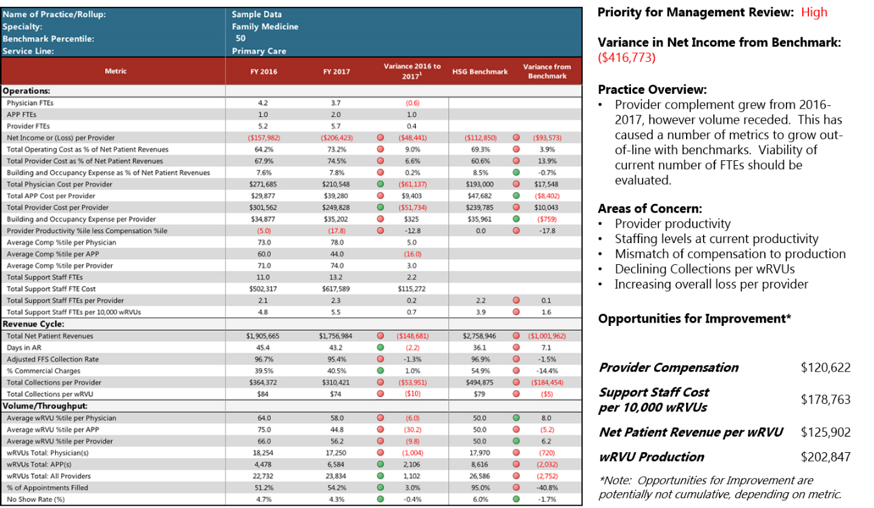

| PHASE ONE — Opportunity identification This Phase focuses on assessing and benchmarking the performance data of the network and collecting management opinions and observations on performance improvement. The output is an overall analysis defining how much financial improvement opportunity is available within the network, and a prioritization of issues to explore more deeply to understand the achievability of potential improvements. SAMPLE ANALYSES Sample Practice Benchmark Summary PHASE TWO — Opportunity exploration PHASE THREE — Implementation

Conclusion |

Reducing Physician Network Losses.pdf |

Download a PDF of this article to share with your team |

Originally Posted by Becker’s Hospital Review: https://www.beckershospitalreview.com/hospital-physician-relationships/reducing-employed-physician-network-losses-and-creating-financial-sustainability.html